One thing they don’t teach you about enough in high school or college is the importance of personal finance. My parents taught me a lot of what I know about personal finance but I wanted to learn more so I took time to read books on investing, retirement, banking, and the basic principles of money. I still have much to learn but I believe I’ve created a strong foundation for myself and have become very responsible when it comes to handling my money. It was easy to keep a track of my money and expenses when my income was minimal and my spending wasn’t major but now that I’ve graduated and have a full-time position I found that it was getting more difficult to see where my money was going. This is when I decided to use a few tools that has allowed me to take complete control of all my spending, savings, and investing choices. Hopefully these tools can provide you with the sense of control and confidence it has given me.

Google Drive

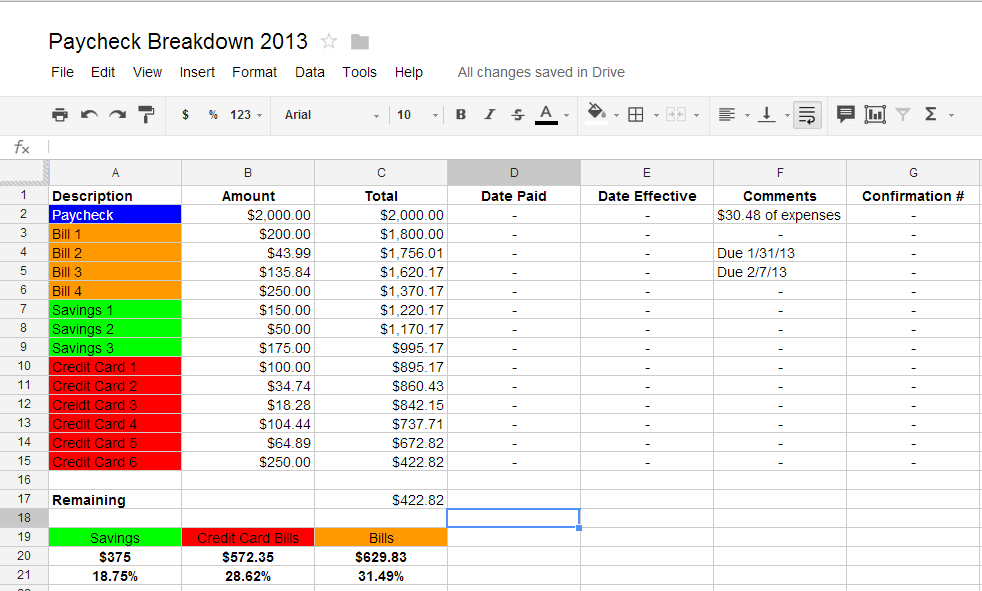

This tool comes with your Gmail account and is basically a place where you can create word documents and spreadsheets but also save them on your email so that you can have access to them whenever you need. I like to upload all my paychecks onto the site for quick reference and I use the spreadsheet tool to make a “Paycheck Breakdown” document. I create one every 2 weeks when I get paid and then decide where my money will go until the next paycheck. The following picture should explain a lot.

I’ve changed the descriptions and numbers but the overall message is still the same. I list my paycheck on the left side and then deduct all my bills, savings, and credit card bills from that source of income. This allows me to see where every dollar is going and to plan for the next few weeks. It also helps to make sure that all my bills are getting paid and shows me what percentage of my paycheck I’m putting towards savings. Once I pay a bill I would mark the date on which I paid it then go back and mark the date on which it was taken out of my bank account. In the comments section I put various notes to myself like what form of payment I used to pay the bills (i.e. checking account or credit card) and the confirmation section is just a documentation cell that I use for reference if I ever needed to dispute or bring up anything. Now that I have a template created, it only takes me about 15 minutes to decide what I’m going to spend my paycheck on each 2 weeks and this has really helped me stay on top of my finances.

www. Mint.com

This is an AMAZING website site that I found about after reading a personal finance post on CNN Money and it has done tremendous things for me. The greatest thing is that it allows you to see ALL of your finances in one location. You input all of your financial information (credit cards, checking accounts, IRAs, investing accounts, 401(k), etc.) and it’s protected by the same encryption that banks use so you’ll feel at ease. This saves a tremendous amount of time because I have multiple accounts which would take me at least 30 mins to check them all. Another great tool is that it allows you to create budgets for the month and we will automatically categorize your spending for you. For example, if you set a budget for gas each month then it will see the transactions that you make at any fuel stations and categorize them into the gas budget so you can see how much you have spent on gas for the month. I use to have a habit of eating out a lot so this budget helps keep me in check so that I don’t overspend. It’s truly a fantastic website that will revolutionize your personal finances and I cannot recommend it enough.

www.creditkarma.com

I’ve learned a tremendous amount of information about a credit score and its components from this website. Its a great learning source with helpful members to answer your questions and great blog posts. But the reason I signed up for the account is the ability to see your credit score on a daily basis for free instead of paying a price. The credit score report card gives you an overview of how well you’re managing your credit and gives you suggestions on how to improve. It also has a credit simulator where you can see what your credit score would be after you take certain actions like pay off a balance or close an account (not a wise choice most of the time). Your credit score might not seem that important to you now since you’re usually not in the market for a house at such young age but a few points could mean the difference between hundreds or thousands of dollars in interest on your mortgage. I’ve learned to be very meticulous about my credit score because when I do need to purchase a house, I want to be able to get the best rate possible. Knowing and improving your credit score can only help you financially and your future self will thank you dearly for taking good care of it.

So these are a few tools that I use to get a hold of my finances with the spreadsheet being something that I created from scratch. If you only do one thing from this post, I hope that you go to creditkarma.com to find out about your credit score for free because this can be an eye opener to jump start your personal finances. I truly believe that being able to properly handle your money will make you a better person and give you more confidence. I know many people worry about money and its a little taboo to speak about it, but we must break away from that and learn to have a serious discussion with our finances. I hope that this post will be that starting point.