I’m currently writing this blog post in the bed of our camper van Olive in Baja California, Mexico with yobo, Boo-yan, and Carp and there isn’t a place where I’d rather be right now. I’ve reached a wonderful equilibrium point in my life where everything seems to be where they should and where I would like them to be. This feeling of balance is occurring in all the major pillars of my life: family & loved ones, physical and mental being, finances, and vocation. I’m truly blessed to be at this point in my life at such a “young” age so that I can maximize, what I hope to be, a long life. My mother-in-law talked about how she’s noticing that her patients were “waking up” and really acknowledging their surroundings and other beings. I feel like this year did that for me where I have woken up and realized the important things I needed to focus on, and what my purpose is in this wild, precious, and singular life that I have. I think Elsie de Wolfe said it best, “I am going to make everything around me beautiful – that will be my life.”

A Life Changing Experience in The Olympic National Forest

Yobo travelled to Nashville for a bachelorette party and flew in/out of Seattle because it was a cheaper flight so I thought I would make a trip out of it by spending a few days in the van but I had no idea where. I recall wanting to visit the Hall of Mosses but never realized that it was in the Olympic National Forest where is basically right in our neighborhood so I decided that was the spot and loaded up the van with myself, Brooks, and Carp for a little fur baby adventure. It worked out perfectly that there was a lot of spots available at the nearby Sol Duc Hot Springs so I decided that was my home base for the trip while I went around to explore the Olympic Forest. I got the visit the Hoh Rainforest where the Hall of Mosses trail was and I was absolutely awestruck by the old growth forest with the towering Western Hemlocks and the abundant, lush, and vibrant mosses that hung from every limb – it was a moss-lover’s paradise. I felt so at-peace and a sense of belonging and warmth – I could spend years there. My most transformative experience occurred when I went to the Sol Duc Falls where I loaded up on some mushroom pills before and smoked a joint at the top followed by some wine and the culmination of my surroundings and the different mind-altering chemicals allowed my being to explore and see things I don’t think was possible otherwise. I remember reading works by John Muir in the van and his quote, “When we try to pick out anything by itself, we find it hitched to everything else in the universe.” really hit home with me and I realized the interconnectedness of this world. To continue with the Earth theme, I had previously downloaded David Attenborough’s A Life on Our Planet and watched it that night and it felt like he was speaking absolute truths to me with the most poignant being that if we wanted to maintain a sustainable life then we need to eat healthy foods. This encouragement helped me change my dietary ways and I try my best to be as conscious as I can about what I put in my body and how I can use my choices to shape what I want the world of food to become – less meat, more vegetables & fruits, regenerative agricultural practices, and treating all life forms in a humane fashion. Lastly, I read a passage from John Muir where he talks about his beloved family horse that died and that illuminated my love for Brooklyn and I came to terms that night that she was eventually going to die and it absolutely devastated me. Since I was by myself with nobody but Brooks and Carp, I let it rip 1000% and just bawled my freaking eyes out and holding Brooklyn and telling her she was the best dog and that I love her so much – she probably had no idea what was going on and scared for her life lol I seriously felt like Gandalf the Grey after fighting the Balrog and leveling up to become Gandalf the White so I went into the Olympic National Forest as Khang and came out as an entirely different person, one who is entwined with nature and the voice of the forest, I became a Kodama.

Je Suis Viva La France

My 3 years of French in high school finally paid off!! lol jk all I basically could say was oui and merci and left the speaking up to Beth who is fluent and the catalyst for the trip since it was her 30th birthday present. France was an amazing experience because I only know Europe from the movies and internet comments and it all made it seem like the French hated Americans but I found everyone to be very friendly, helpful, and accommodating. I also don’t know why I thought the Europeans were less “sophisticated” in terms of technology than the US but their public transportation system freaking blew ours out of the water, it wasn’t even comparable. Albeit, I’ve only had a few experiences with the US public transportation system in Oregon, Washington, California, and Pennsylvania. We visited a lot of great places like Paris, Nantes, Domme, Arles, and the Pont-du-Gard. Nantes was where Beth studied abroad and my favorite city that we visited – I would love to be able to live and work there. It was a dream city for me where the restaurants were incredibly delicious, the walkability of the city was fantastic, the people and culture was extremely pleasant, and there were people hanging out at the train station!! I can’t even begin to imagine people wanting to hang out at Union Station in downtown Portland, you definitely try to spend the least amount of time as possible at Union Station unless you want to get robbed or stabbed lol My time in France opened my eyes to what life could be like when you can don’t have to worry about the hustle the whole time, the entire place had a “college feel” where people walked and biked to places they needed to go and spent the afternoons chilling with their friends. Of course this was me with my le vie en rose as a tourist but it let my imagination sore of what life could be like in a city. We ended the trip by flying out of London and I got to visit Stamford Bridge!! It was the stadium of my favorite football club Chelsea and it was so cool to see the plaques of all of my favorite players like Zola, Drogba, Lampard, Terry, Cech, Cole, but no Jose Mourinho sadly. The last event we did on this trip was go watch Mammia Mia! and it was bloody brilliant!! The cast as out of this world and we had such a great time listening to the wonderful songs and getting to sing at the end with the crew – highly recommended!

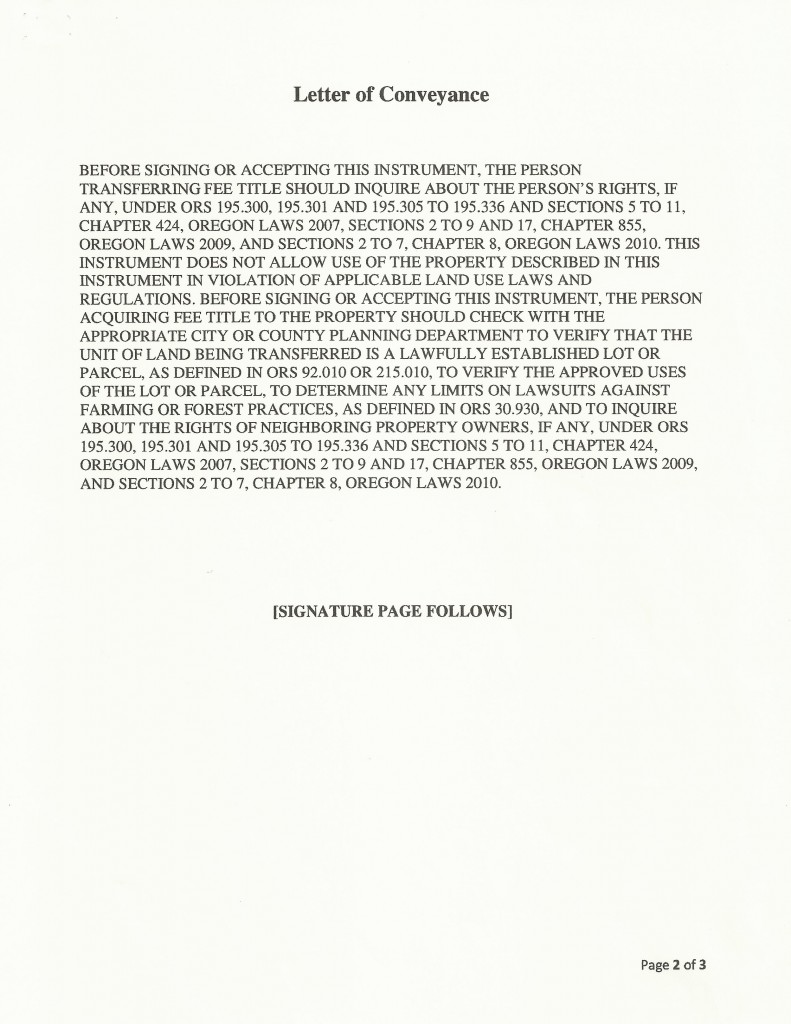

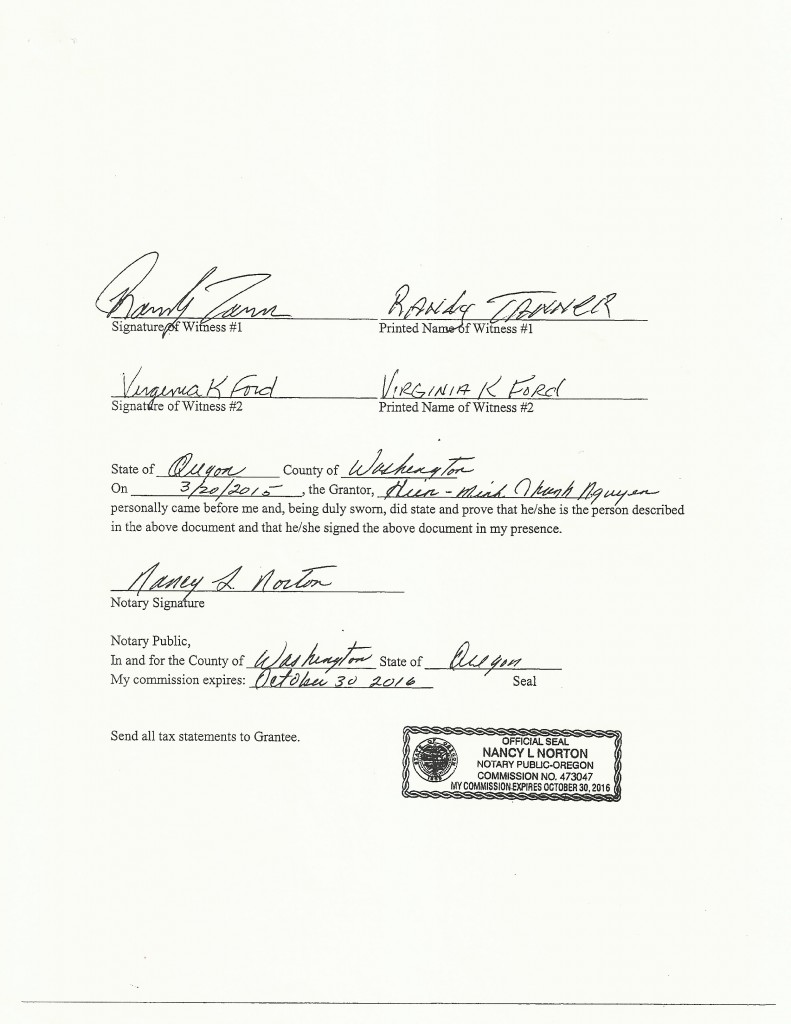

Not sure why the images are so tiny lol

Not sure why the images are so tiny lol

Olive – Our Millennial #VanLife Dream Come True

We first got the notion that van life could be the thing for us after renting a camper van from GoCamp and traveling down the west coast on the 101 for our honeymoon. It was an incredible experience and we loved every minute of it. We were already used to spending every second together because of Covid and our living situation where we live in a 500 SF studio basement where we work right next to each other – we are one now and know no boundaries lol We did a lot of research and bit the bullet and put in an order for a brand new Ford Transit which we received in June 2022 and finished the build in March of 2023 in time for a trip to Lake Havasu to spend time with Beth’s dad and his wife. That van build tested the limits of marriage and we rarely fought before the van but man did we have a lot of fights while building it! There was one fight that occurred during a dog walk where Beth got so frustrated at me that she threw down the dog leash and started to walk home and I knew I had to follow her back instead of continuing on the dog walk if I wanted to remain being married and building this van lol Literally every screw in van was put in either by me or Beth and we felt such a strong feeling of accomplishment when we were done and celebrated with a very nice dinner at our favorite restaurant Ok Omens. The meal was a celebration of the completion of the van but most importantly that we did not kill each other lol We’ve taken Olive on so many adventures and this is definitely going to be a time that we look fondly back on as our “hippie” days when we traveled across the country living out of our van with our dog and cat. The part that blows me away the most is that we had a dream and we were able to bring it to fruition, literally. Every time we do a trip in it, I’m blown away that all the things still function and we were able to do all of it ourselves; DIY = Do It with YouTube!! Just this year we took the van to Lake Havasu, Las Vegas, Joseph, La Grande, Olympic National Forest, Mt. Hood, Baja California, and of course our cross country trip to Vermont for a friend’s wedding. Olive has brought so much joy and adventure in our lives and I’m really happy we had the courage to take on this endeavor and it has really helped take our marriage to another level.

Alexis (Ren) Becoming a Musician

This was the year that Alexis and us really started to share her love for music because we went to so many concerts together including ones that she played in with her school orchestra and band! It brings such a smile to my heart knowing that she is able to pursue something that she really loves and enjoys. Beth and I are both big fans of music and the arts so it’s been fantastic learning about new artists from her like BeaBaDooBee, Laufey, Men I Trust, Steve Lacey, Tyler the Creator, Yves Tumor, TXT, and so many more! She is also becoming quite the playing musician with her work on her violin along with the electric bass guitar that we got her for her birthday – she is also taking private lessons and I think that has really helped her get deeper into the music because I definitely do not have the skills nor knowledge to answer her musical questions lol I’m so excited to see her music skills blossom as she continues the practice and I look forward in supporting her every step of the way.

Parents Retired!!!

My Mommy and Ba retired this year after working ever since they were kids in Vietnam!! I’m so happy that they are able to have this moment in their life where they don’t have to work and can truly enjoy their life together with no worries of an occupation. Most importantly, they were able to get to a spot financially where they are comfortable to live within their means and it brings me great joy to see them become much happier versions of themselves. They gave and taught me the work ethic I have today and I would not be here without the sacrifices they made for our family by working crazy hours when our family needed them to. I’m forever grateful for everything they’ve done and extremely proud that they are able to retire so they can live their best lives into the future. It is magical seeing them nowadays as they are always beaming and truly enjoying the fruits of their life’s work and labor – I’m beyond happy for them! If you’re reading this Mommy and Ba, I love you very mucho and thank you for all your sacrifices and enjoy your retirement!