I’m not special.

I don’t come from a wealthy family, I didn’t win the lottery, and I don’t have a 6-figure income, nor am I a genius.

I’m your typical Millennial that graduated college with student loans, although I’m in the STEM field with a decent income for a recent graduate. My goal is to help inspire Millennials and other generations that debt is not a way of life, not everyone has debt and there is a plan to help guide you through the process. Below is the story of my financial paradigm shift from a typical American to a Debt-Free believer.

Living Like Everyone Else

The initial point of my debt-free journey occurred a few weeks after my 26th birthday on a February Sunday in 2015. Up to this point, I was extremely comfortable with my life and thought that I was financially secure. I graduated from Oregon State in 2012 with an engineering degree and had a job already lined up at graduation making $56,000/year which is something that was unfathomable to a broke college student like I was. Fast forward to 2015 and here I was saddled with student loan and credit card payments and to my great chagrin, a car payment because I felt that I could “afford” my dream car (a Honda S2000). I also got wrapped up in a bad video game addiction that had been haunting me all my life since I got a Nintendo Gameboy. My life was falling into a rut where I was blinded and falling into a deep, deep hole. I would go to work, go home, play video games, pay bills, sleep, and repeat the process. The video game addiction was starting to interfere with my personal life where I would spend my weekdays when I got off work and more than 20+ hours on the weekends playing games. It also started to seep into my work performance and that’s when I knew that things were starting to get bad.

Dave Ramsey and a Cold Turkey

I’ve always been a fan of personal finance with my interest starting at a young age where I asked my parents at 16 to help me open a Roth IRA so I could see what it was like to purchase stocks and mutual funds. I had a credit card with my mom at 15 and had a checking account along with a savings account therefore I considered myself “financially savvy” for my young age. Now as an emerging adult, the name Dave Ramsey came up a few times through my forays into the personal finance space of the internet but I never really paid him any attention. My coworker introduced me to podcasts and I downloaded a few episodes of the Dave Ramsey Show on my phone but didn’t listen to them – I was too addicted to the Serial podcast! Little did I know, the planets were already aligning to open the gate for my Debt-Free journey.

On a Sunday night in early February after a 16 hour bender of video games (DotA being my drug of choice) I stumbled like a zombie back to my room that I share with Alexis (daughter) and Tiffany (girlfriend) – we sleep on a bunk bed 😀 As I climbed the short ladder to the top bunk, Alexis’ butterfly night light illuminated both of their faces perfectly and flashed an epiphany in my mind. I heard a voice asking me if I loved my video games more than my family and why I couldn’t see the unintentional pain that I was causing them. Rather than spending time with them and putting them to sleep, I was in the other room wasting my life away in an unforgiving virtual realm. My inner eye was finally opened to the potential repercussions of my current path: losing my job, alienating my family, destroying my other relationships, and extinguishing any potential I had in this life. As I lay in bed, I made a vow that I would quit playing video games and I would refocus my energy to better my life. As corny as it sounds, I shook my own hand because I’ve always believed that a man is only as good as his word and that was a principle that I lived on.

The following morning I deleted DotA from my laptop along with the back-up file I had in my external hard drive therefore I had no way of getting the game again without considerable effort. I know I needed something else to latch on now that I didn’t have video games preoccupying my time. That same morning on my drive to work I decided to listen to my downloaded Dave Ramsey episodes and the rest is history…

Battle of the 5 Debts

I put pen to paper and listed my debts from smallest to largest to visualize how big and mean this monster was that I had to vanquish. The evil horde consisted of five demonic debts:

1. Phone Bill – $432 (I bought my mom a new iPhone for Mother’s day on a payment plan)

2. Credit Card – $1,645 (Remaining debt of my vacation to Florida TWO years prior)

3. Student Loans – $15,034 (I received my BS from Oregon State in Construction Engineering Management)

4. Car Loan – $18,968 (My beautiful Grace, a 2005 Honda S2000 with 45k miles)

5. Parent PLUS Loans – $44,052 (My parents sacrificed so much to put me through college therefore I wanted to repay them by taking over the loan payments)

Total = $80,131

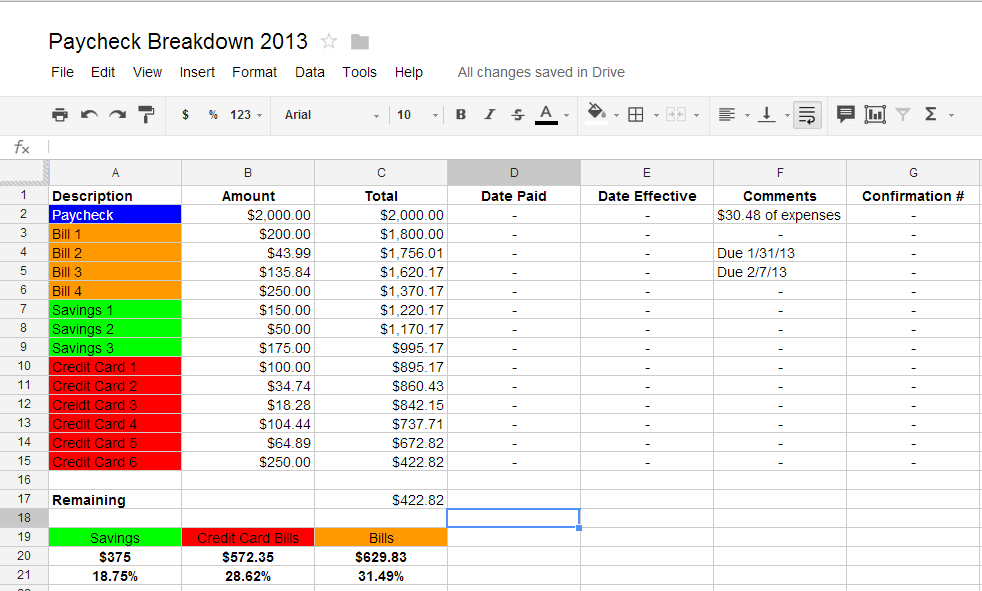

The Debt Snowball

Dave Ramsey’s recommendation to getting out of debt is using the “Debt Snowball Method” where you list your debts from smallest to largest regardless of interest rate and work your way up the ladder. Once you pay off a debt, you use that monthly payment and add it to the snowball so that when you’re on your final debt the snowball resembles an avalanche! The debt-snow ball is a simple equation:

Debt Snowball = Income – Expenses

To increase the rate of paying off debt there is only 2 variables that you can modify, either increasing your income or lowering your expenses. I did as much as I could to change both variables so that I could finish this journey ASAP! I was making too much money to be so broke, I was sick and tired of being sick and tired. My initial timeline showed me completing the journey in 26 months.

The most important thing I learned about getting debt free is that it’s not your weekend 5k fun run, it is Forrest Gump running across the country!! It requires 100% commitment from you physically, mentally, and spiritually – you will not succeed unless you get “gazelle-intense” and take it seriously.

Increasing Income

I knew I had to increase my income if I wanted to tackle this debt and Dave talks about getting a part-time job with pizza delivery being his go-to job recommendation. I didn’t think being a pizza delivery boy would work for me because A) I had a full-time job and the hours could potentially conflict B) my hours would vary from week to week. Therefore I searched for part-time jobs on Craigslist and found a perfect one! I was going to be a garbage man!

ZipEco (formerly Ecommunity)

The job was from 8-11 PM every day of the week except for Tuesday and Friday nights which basically meant that I would have to skew my work/life balance to the extreme. The other dagger was that it was in Vancouver, WA therefore I had a 40 minute commute each way to get to work. Fortunately, the pay was good and I had a fixed schedule that I could work with.

The apartment complex I was servicing consisted of 188 units and the tenants would leave their trash and recyclables in containers in front of their doors. My job was to carry these items from the door step to a centralized area that included a trash compactor and recycling bins. It was a physically demanding job but I was not scared of doing manual labor because I’ve spent many summers doing those types of jobs. Another odd thing was I never complained or felt angry about doing this job because I was doing the job for a greater purpose. I was “living like no one else so that later I could live like no one else.” That was my life for 12 months, I would work at my day job as an engineer till 4:30 PM, go home to eat and usually take a quick nap, head off to my part-time trash job at 7:00 PM, get home at 11:30 PM and then wake up at 6:00 AM to lather, rinse, and repeat. Adding this part-time job helped me reduce my journey by 9 months!

Additional Income

I did various things to increase my income as much as possible including:

• Driving for Uber

• Selling Plasma

• Selling everything I could on Craigslist

• Liquidating my stocks ($10,000) and decreasing my savings account from $15,000 to $1,000

• Taking out all the money that I had saved for Alexis’ college fund ($5,500)

• Selling all my silver at a 60% loss (never buying commodities as an investment again!)

• Eliminated my CarMax warranty (I didn’t even know you could do this until Dave mentioned it on his radio show)

Lowering Expenses

The greatest expense reducer I had was being able to live with my parents – if you have this option available then I highly suggest moving in with your parents to help boost your debt-free journey. Of course, make sure everyone is on the same page with a goal in mind of when you’re going to move out and what expenses you’ll be helping with. I am an only child and in the Vietnamese culture it’s not odd that children live with their parents for a prolonged time period – my grandma is currently living with my aunt and has lived with us as well for several years. I don’t pay rent but I do pay utilities to aid my parents in their household expenses and I also promised them I would take on additional expenses once I’m finished with this journey. Living with my parents has been a tremendous boost to me getting debt-free because they gave me support and have helped me cover so many typical expenses that I don’t have to pay for like laundry and groceries. I could not have done this without my parents.

Public Transportation

Another aspect of reducing my expenses was no longer driving to work but taking the public railway and even better my company pays for 50% of the public transportation costs! Another added benefit was now I get to read books instead of sitting in traffic. I usually spent around $20 on gas a week and countless wasted hours but now my commuting cost was $12.5/week which equates to almost $400 a year – this doesn’t include the wear and tear on the vehicle and of course the decreased probability of getting in a traffic accident which is astronomically higher due to Oregonian’s terrible, horrible, no-good driving abilities.

Bringing Lunch from Home

I started to bring my own lunch instead of going to fast-food restaurants. Typically, I was spending around $6 for lunch every day and eating non-healthy foods – the simple math shows that I was spending $30/week or $1,560/year on eating out at lunch. Bringing my own food allowed me to eat healthier and eliminated a big expense that I never really thought about.

No Social Life

A sacrifice I made was that I rarely, if ever, went to any entertainment or social events with friends and family. I didn’t go out to dinner, no movies, and no more nights out to the bars and clubs. This made me miss going away parties, birthday parties, celebratory parties, and all awesome parties in general! I was okay with making this sacrifice because it was only a temporary pause on my social life, I only needed 2 years to complete the journey and then I could enjoy myself without charging a big night out and then paying for it in monthly installments.

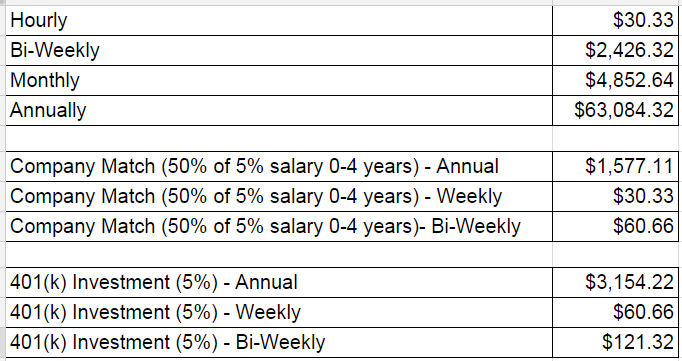

Stopping 401(k) Contribution

This cut was probably the moment I knew that I was fully committed to my Debt-Free journey. I loved investing in my 401(k) but I was diluting my goal by spending potential debt money into an investment. I was basically borrowing debt to be able to invest and that was not a smart move. I did a calculation on what I was giving up from my company match by not investing in the 401(k) and it was around $1,500 a year but to get the match I was also “sacrificing” $3,000 of income. I decided that I was diving into this thing 1,000% and changed my contribution to 0% and didn’t look back! Of course, when I get debt-free I will bump my contributions back to 15% as taught in Baby Step 4.

I’M DEBT FREE!!!!!!!!!!!!

This has been one of the hardest things I’ve ever done in my life. It required me to be fully committed to a goal that demanded my body, my mind, my relationships, and every inch of my life. I had to do a complete paradigm shift of my thoughts about money and how I viewed debt. I literally lived like no one else and now I can finally live like no one else. I sacrificed and took every principle Dave offered to help me through this journey. I was able to pay off my $80,000 of debt faster than I imagined and finished in 12 months! It’s really amazing how the universe starts to help you when you’re on this journey. I had money coming in from unexpected places and opportunities opened up that allowed me to get additional income. Break the chains that debt has on you because the borrower is truly a slave to the lender! I hope my story gives you inspiration to start your own debt-free journey because the view is magnificent from the top and when you don’t owe a single penny to anyone!!

There were two quotes I kept repeating as I went through this journey:

“If you really want to do something, you’ll find a way. If you don’t, you’ll find an excuse” – Jim Rohn

“Live like no one else so later you can live like no one else” – Dave Ramsey

I sacrificed a year of my life for an eternity of freedom and I would make the exchange again EVERY TIME.

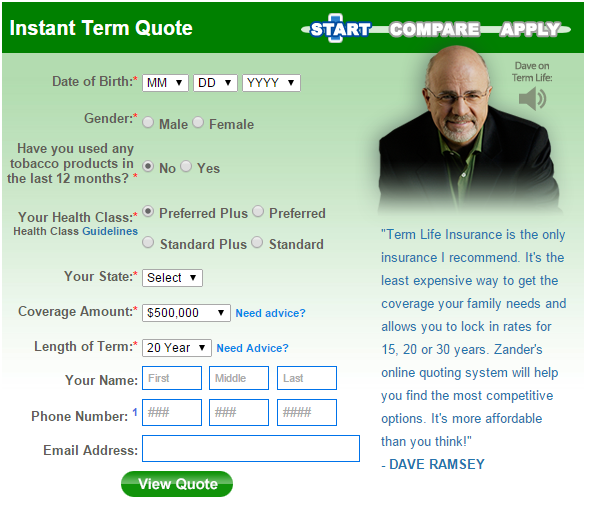

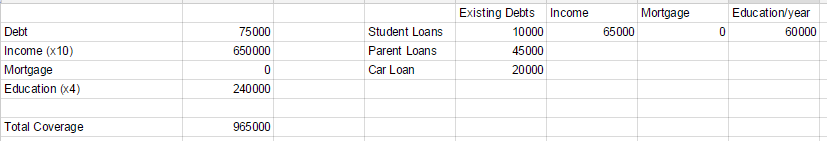

The second question is, “what type of insurance should I get?”. The two most widely used out there is Whole Life and Term Life insurance. Whole Life provides you with a coverage amount you set and a higher premium where the additional dollars above your premium goes into an account that builds your “equity”. Dave Ramsey does not approve this method as you can make more money by taking those additional dollars and invest it yourself. Also, life insurance is not needed for your “Whole” life because as soon as you become fairly wealthy then your family should be financially stable enough to handle any money issues. Term life insurance is similar to car insurance where you pick an amount of coverage and a “term” of how long you want the insurance for. This is the one that I went with because, as I mentioned before, you shouldn’t need life insurance for the rest of your life and it provides the best option with the lowest premium.

The second question is, “what type of insurance should I get?”. The two most widely used out there is Whole Life and Term Life insurance. Whole Life provides you with a coverage amount you set and a higher premium where the additional dollars above your premium goes into an account that builds your “equity”. Dave Ramsey does not approve this method as you can make more money by taking those additional dollars and invest it yourself. Also, life insurance is not needed for your “Whole” life because as soon as you become fairly wealthy then your family should be financially stable enough to handle any money issues. Term life insurance is similar to car insurance where you pick an amount of coverage and a “term” of how long you want the insurance for. This is the one that I went with because, as I mentioned before, you shouldn’t need life insurance for the rest of your life and it provides the best option with the lowest premium.