Dave Ramsey released last Monday 3/23/15 what he has called the best budgeting tool available therefore I thought I would take it for a test spin and see if it’s better than the Mint or the custom Excel spreadsheet I made. The product is called Every Dollar and there is a free version along with a Plus version that costs $99/year which allows you to sync transactions with your bank accounts (basically what Mint does for free). The log in screen is the same as any other website where you would need a username/password. However, the verification email that they send can take up to several hours! It also gets easily lost in your junk email therefore it’s best to check in there first if you don’t see it within a few minutes. In this day and age, and after Dave spent a couple million bucks to get this running, it should only take a few seconds to receive a verification email not several hours. The website itself is very beautiful and easy to navigate as you can see below. Categories are very cleanly separated with a distinguished tab to help you differentiate between your budget items; the initial category is your income where your budget should start and the default categories are giving, savings, housing, transportation, food, lifestyle, insurance & tax, and lastly your debt. These categories then have smaller sub-categories where you can add your own custom budget line item. An extra item they have on the side is the “Baby Steps” which is Dave Ramsey’s steps to becoming financially wealthy and I think it’s a nice touch but seems a little weird to me that it’s included in the tool – but it’s his budgeting tool so how could he not sneak it in there??

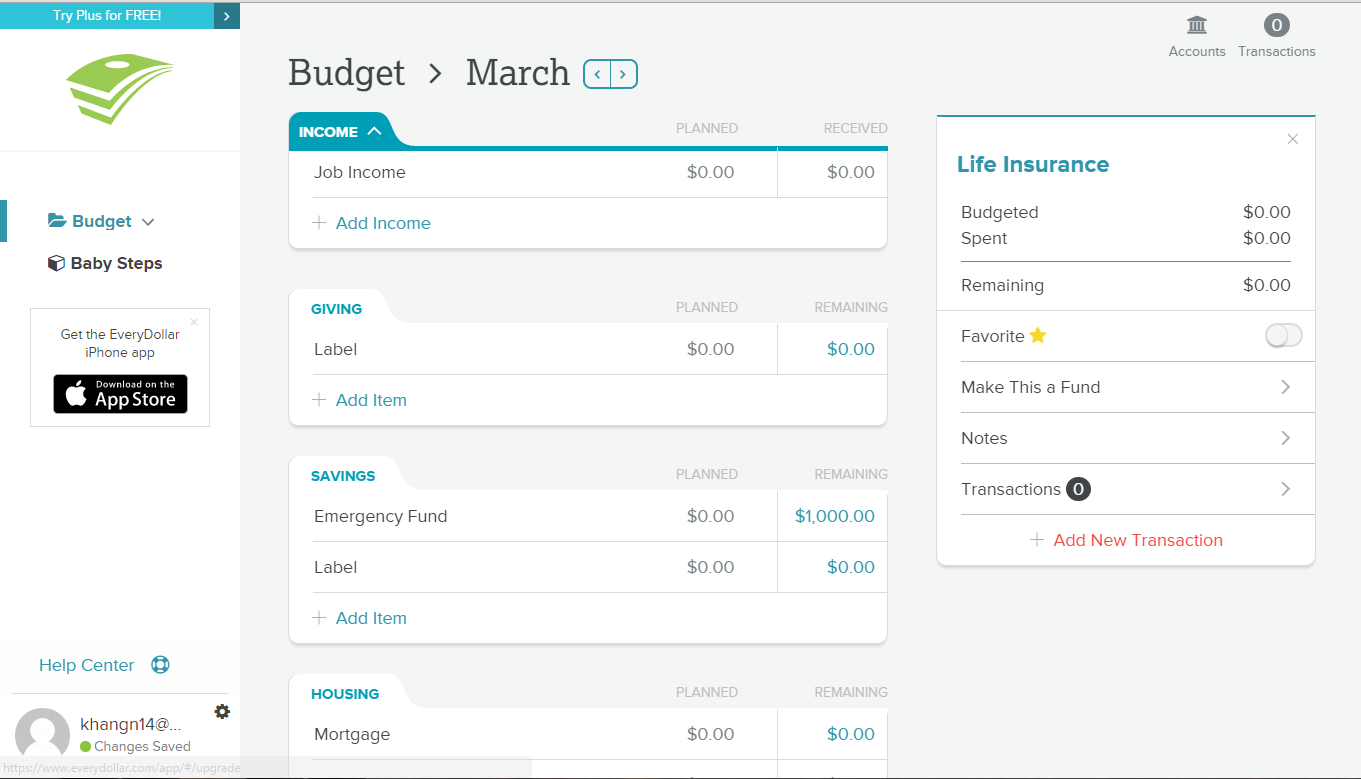

The website itself is very beautiful and easy to navigate as you can see below. Categories are very cleanly separated with a distinguished tab to help you differentiate between your budget items; the initial category is your income where your budget should start and the default categories are giving, savings, housing, transportation, food, lifestyle, insurance & tax, and lastly your debt. These categories then have smaller sub-categories where you can add your own custom budget line item. An extra item they have on the side is the “Baby Steps” which is Dave Ramsey’s steps to becoming financially wealthy and I think it’s a nice touch but seems a little weird to me that it’s included in the tool – but it’s his budgeting tool so how could he not sneak it in there??

The initial step is to put in your monthly income and then move down the line to fill out all you budget items. A nice feature is that as you scroll down the screen, the amount that you have left to budget is locked at the top for you to see. You can also click on the remaining amount and that will toggle the website to switch to how much you’ve spent in your budget. This gets a little annoying because I thought I could change the spent amount by clicking it but I can only do that through the added transactions. Speaking of the transactions, this is where the budget tool fails miserably and makes it no better than a mediocre tool.

The initial step is to put in your monthly income and then move down the line to fill out all you budget items. A nice feature is that as you scroll down the screen, the amount that you have left to budget is locked at the top for you to see. You can also click on the remaining amount and that will toggle the website to switch to how much you’ve spent in your budget. This gets a little annoying because I thought I could change the spent amount by clicking it but I can only do that through the added transactions. Speaking of the transactions, this is where the budget tool fails miserably and makes it no better than a mediocre tool.

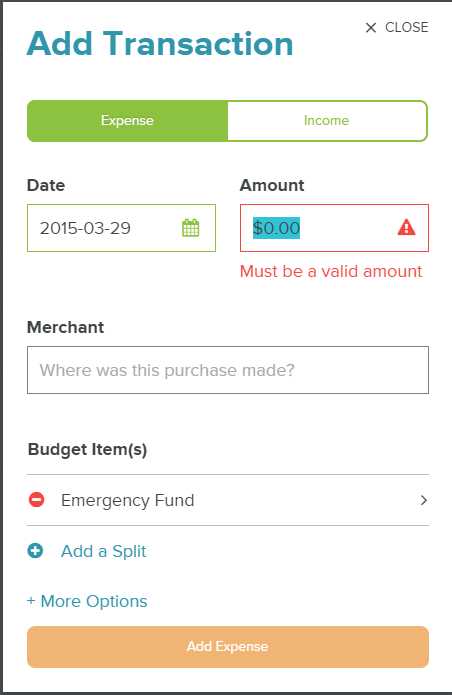

To add a transaction, you click on the budget category and click on add new transaction to the right. The screen lets you add either an expense or income and asks you for the date and amount. As you get more transactions then you have to manually input them into your budget category but if you have the Plus version then your transactions will automatically populate from your bank accounts. As you can imagine, this can become extremely time consuming with the number of transactions you have. Budgeting is a struggle for most people already and making it as time consuming as possible creates a difficult obstacle for people to overcome.

To add a transaction, you click on the budget category and click on add new transaction to the right. The screen lets you add either an expense or income and asks you for the date and amount. As you get more transactions then you have to manually input them into your budget category but if you have the Plus version then your transactions will automatically populate from your bank accounts. As you can imagine, this can become extremely time consuming with the number of transactions you have. Budgeting is a struggle for most people already and making it as time consuming as possible creates a difficult obstacle for people to overcome.

And that’s pretty much Every Dollar in a nutshell because that’s all budgeting is – starting off with your income amount and then subtracting all your expenses until you’re down to 0.

The downfall of Every Dollar is that you have to manually input the transactions and you have to PAY if you want the automatic transactions. With Mint, you get the transactions for FREE and it’s very easy to categorize them into your budget items. If I were you, I would not purchase the Plus version because you can do everything with Mint and you also get all the balances of your other accounts as well. The website does look nice but doesn’t do anything special that Mint or my custom excel doesn’t already do. If they make the Plus version free then they might have a fighting chance but for now, it is an inferior product to Mint’s budgeting tool and his statement of best budgeting tool available is definitely an overstatement.

In conclusion, Every Dollar is too time consuming to be a worthwhile budgeting tool because you have to manually input all your transactions. Stick with Mint if you want the best bang for your buck (FREE) and time. I hate to say it but I think Dave Ramsey made a bad investment by spending $3-4 million dollars and multiple years on this product. The only reason this budgeting tool is getting any traffic at all is because it’s backed by Dave Ramsey; if it wasn’t then it would just be another mediocre tool lost in the ether of the internet.

After you complete your questionnaire at the kiosk you will sit down in a lobby or wait in line until you’re called by a technician to complete your shortened health screening. Below is a picture of the lobby of the place I used to donate at in Portland. I’ve covered the face of the individuals to protect their privacy.

After you complete your questionnaire at the kiosk you will sit down in a lobby or wait in line until you’re called by a technician to complete your shortened health screening. Below is a picture of the lobby of the place I used to donate at in Portland. I’ve covered the face of the individuals to protect their privacy.

You’ll quickly find out that they ask for your full name and last 4 digits of your social security very often. Not sure if this is to verify if you’re the same person (I know, I know…) or to make sure you’re still thinking properly and not high off your ass. You can’t see in the photo above but there is a scale just behind the chair and that is what they’ll have you do first. This is important because there are 3 ranges for the amount of plasma you have to donate correlating to your weight – I weighed around 160 and was in the middle band which required me to donate 880 ML. At some centers you get more/less money (+/-

You’ll quickly find out that they ask for your full name and last 4 digits of your social security very often. Not sure if this is to verify if you’re the same person (I know, I know…) or to make sure you’re still thinking properly and not high off your ass. You can’t see in the photo above but there is a scale just behind the chair and that is what they’ll have you do first. This is important because there are 3 ranges for the amount of plasma you have to donate correlating to your weight – I weighed around 160 and was in the middle band which required me to donate 880 ML. At some centers you get more/less money (+/-

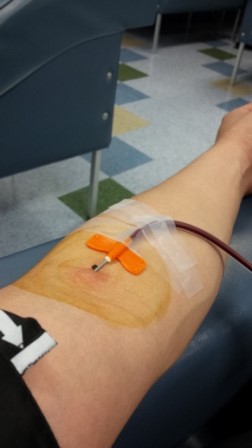

After you near the end of your donation, they’ll either give you a saline pack through the IV or make you drink a bottle of electrolytes (Powerade or Gatorade) to help you replenish the fluids you’ve just lost. After that you’re all done and you get paid!

After you near the end of your donation, they’ll either give you a saline pack through the IV or make you drink a bottle of electrolytes (Powerade or Gatorade) to help you replenish the fluids you’ve just lost. After that you’re all done and you get paid!