Working in the construction industry has allowed me to meet a lot of individuals and fellow coworkers who own rental properties because they’re in the real estate industry every day whether its commercial or residential therefore it’s a perfect synergy. I always thought that rental property was something that only rich people have but I came to see that was not the case, however, the majority of them still had mortgages on the property. This is how I found out that some people created an LLC and transferred the title over to the company to protect their own personal assets. I then discussed the topic with my parents and this is also something they wanted to do to their commercial property and asked me if I would help them. Of course I said yes and it was an awesome learning experience setting up the LLC, writing the quit claim deed and then getting it recorded with the county clerk. Here is my post about the process but it’s tailored to Oregon/Multnomah County so you might have to just exchange the websites for your own state and county.

Step 1: Verify with your Mortgage Lender

I found out through my research that there are some mortgage lenders who have a “due clause” written into the mortgage contract that if the title changes hands then they have a right to demand that the full mortgage amount becomes due. Therefore, it is imperative that you check with your mortgage lender that they’ll allow you to transfer the title from your name to an LLC before you do any of the steps below.

Step 2: Creating an LLC

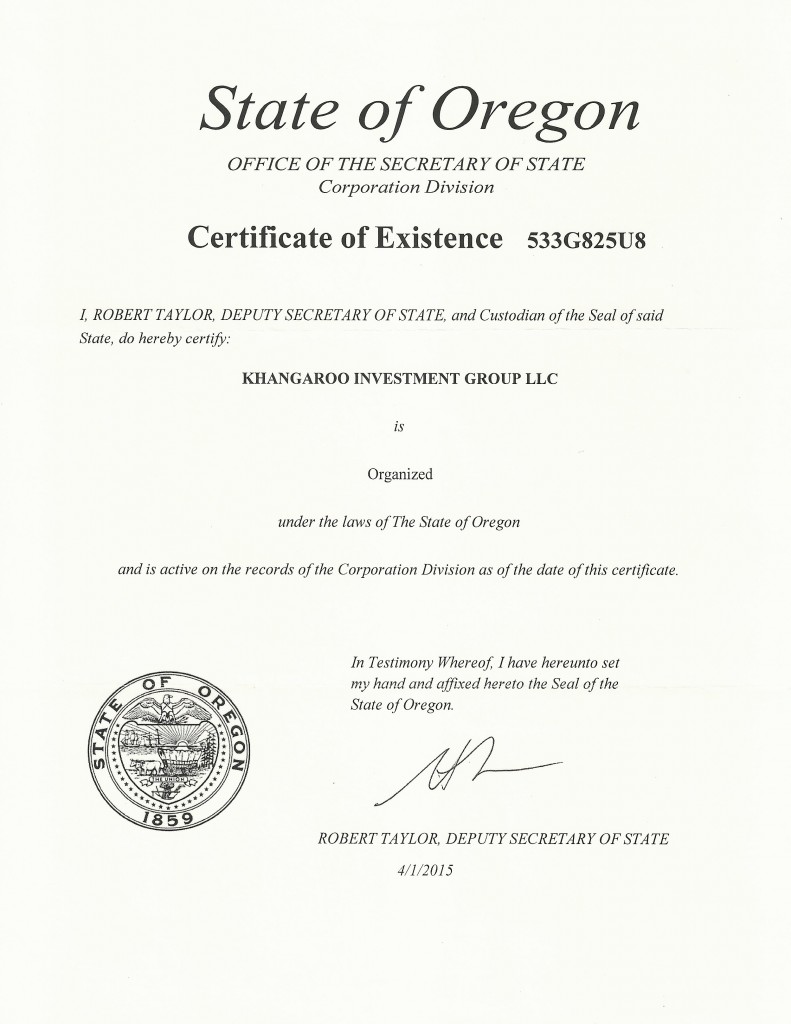

In Oregon, they have an electronic filing system to register your company therefore it makes things a lot easier – it took me less than an hour. You register your company through the Oregon Secretary of State and follow the prompts. During the process, they’ll also make you sign up with the IRS and get an Employer Identification Number for tax purposes. Once you complete the process, you’ll get a confirmation from the SoS with your “Articles of Organization” and can print out a “Certificate of Existence” to display on your company’s premises – I believe the total cost was $60. Here’s my LLC’s CoE and this along with the AoO will be important documents in the next step.

Step 3: Business Checking Account

Step 3: Business Checking Account

The next part is to create a checking account under the name of your business. This will help uphold the “Corporate Veil” where there is no mingling between your finances and the company’s. Any monetary transaction for the property needs to go through this account and that includes rent, improvements, salary (if you decide to pay yourself or someone else), misc. expenses, etc. The majority of banks and credit unions have a business checking option and you should shop around for which best fits the needs of your LLC.

Step 4: Transferring the Title with a Quit Claim Deed

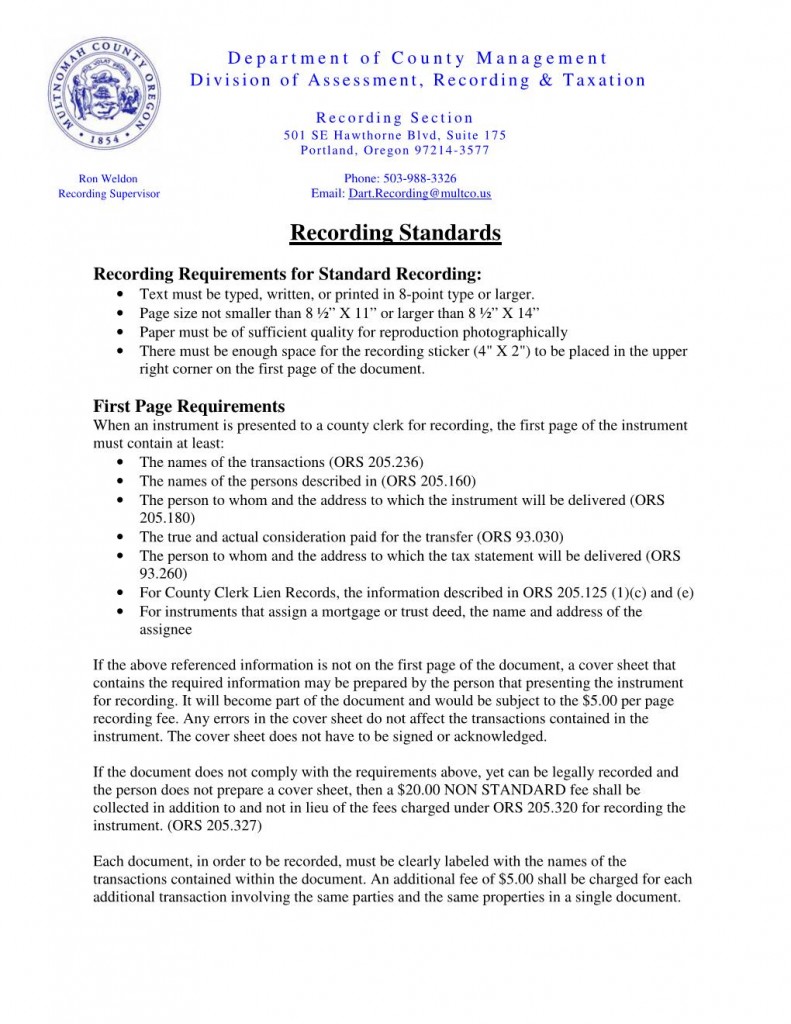

Using a Quit Claim Deed, you’ll be able to transfer the title of the property from you to the LLC. There are specific requirements from your county’s recording office on how these need to be drafted and what information is required. These are the recording requirements for Multnomah County in Oregon:

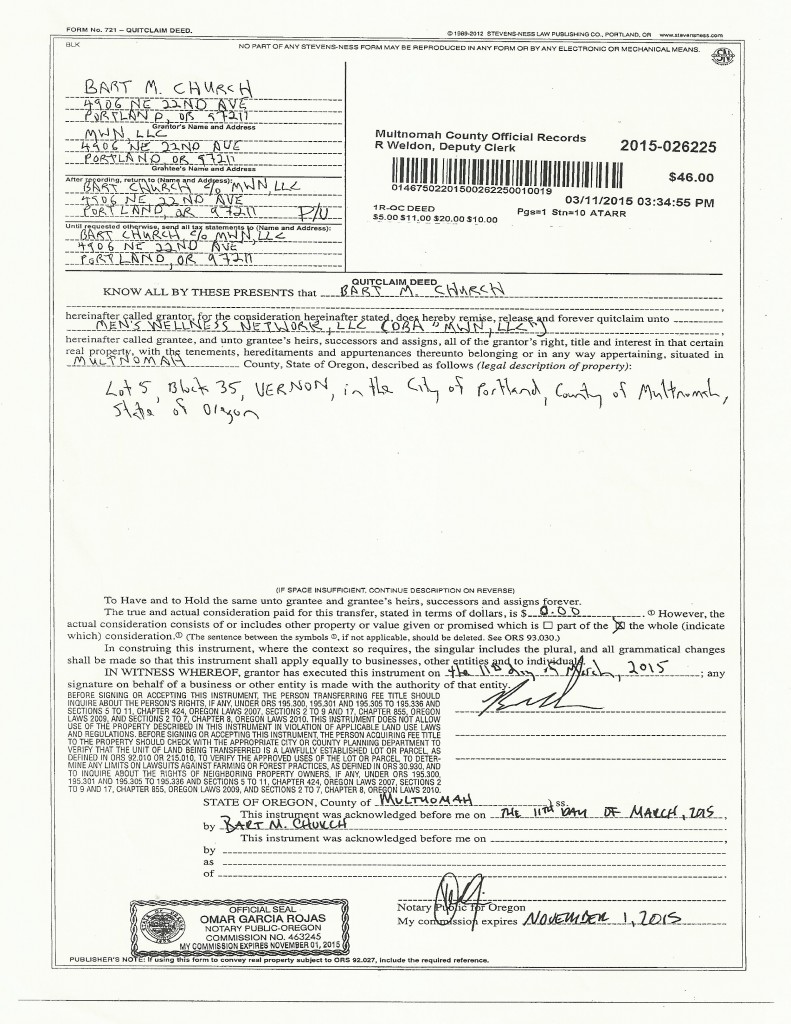

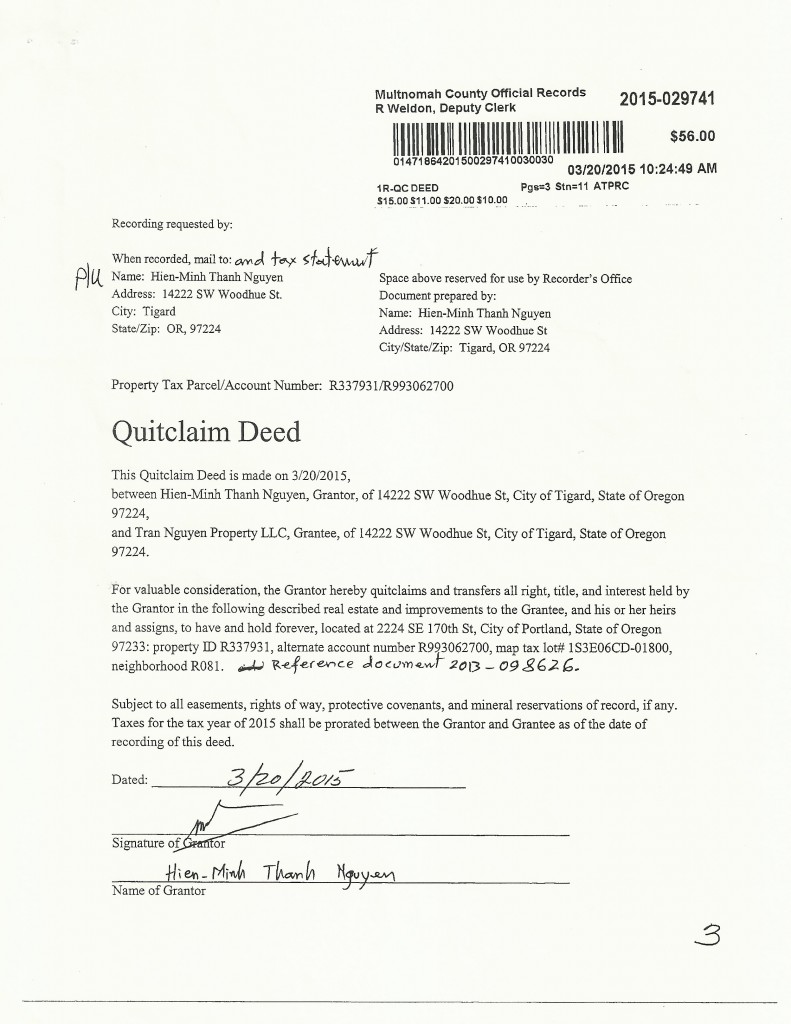

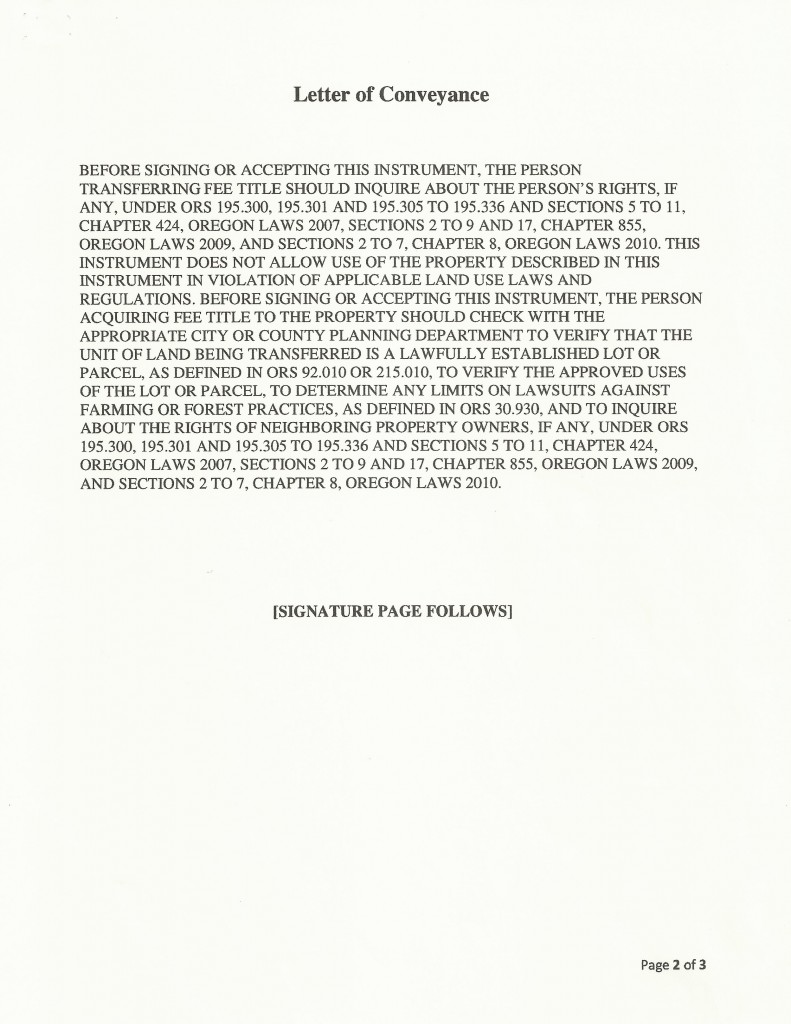

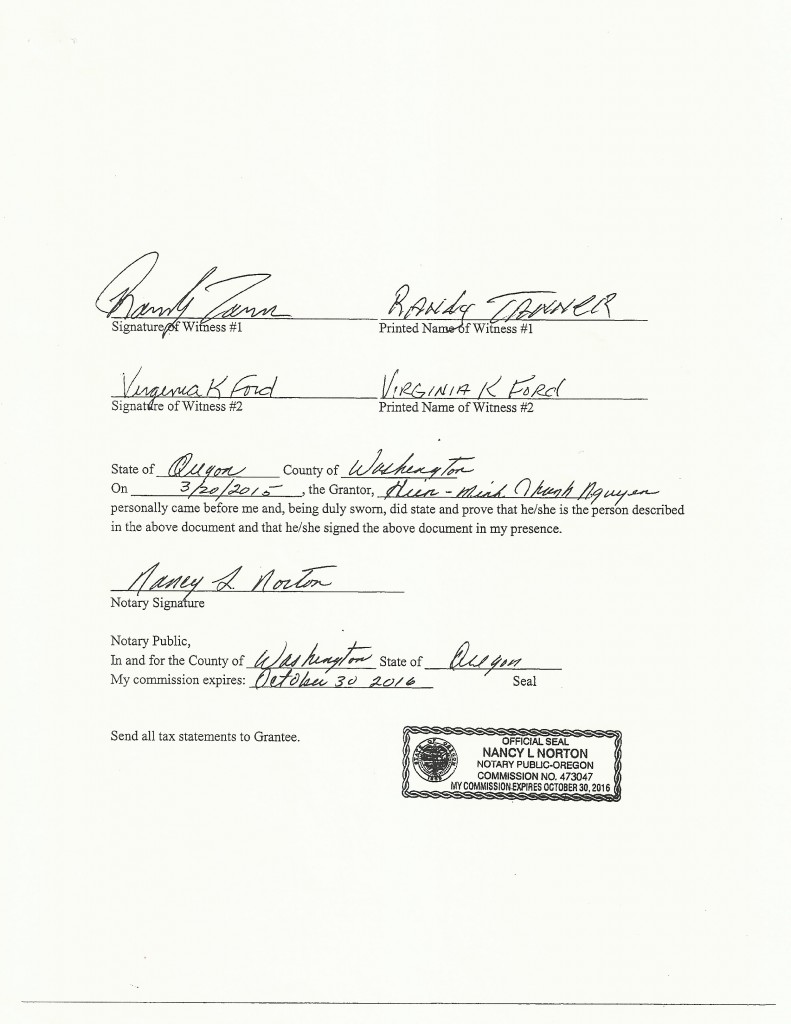

You can draft the Quit Claim Deed yourself or look up the public deeds at the Recorder’s office and create a similar one – this is what I did. It’s all public information and the county had a nice option where you can just search for Quit Claim Deeds – all you have to do is pay a few dollars to get it printed. Here are some examples that I copied for my own Quit Claim Deed:

You can draft the Quit Claim Deed yourself or look up the public deeds at the Recorder’s office and create a similar one – this is what I did. It’s all public information and the county had a nice option where you can just search for Quit Claim Deeds – all you have to do is pay a few dollars to get it printed. Here are some examples that I copied for my own Quit Claim Deed:

It’s very important that you include all the information required by the Recorder or this could mess up your documentation. Luckily, the clerks are very helpful and they helped me a lot through this whole process. Also, if you’re trying to minimize costs then you can limit it to a single page like the first example because each page was a $5 cost and that can add up quickly.

It’s very important that you include all the information required by the Recorder or this could mess up your documentation. Luckily, the clerks are very helpful and they helped me a lot through this whole process. Also, if you’re trying to minimize costs then you can limit it to a single page like the first example because each page was a $5 cost and that can add up quickly.

After you get all your documents completed, you just submit them to the Recorder to enter into the public domain and the transfer is complete! The property is no longer under your name but the LLC and if someone decides to sue you then only the assets in the LLC are at risk. I believe this is a very important tool that everyone who owns rental property should look in to. The overall cost of the process was $180 for me and didn’t include my time but it was a great learning experience so I enjoyed every minute of it. If you don’t want to spend the time then you can have a lawyer complete this for you but I guarantee there won’t be one who will complete if for less than $200. If you can find a lawyer who will do this for $200 then message me and I’ll PAY YOU to get it done!

Thanks for reading and good luck!

Disclaimer: This is for general information purposes only. I recommend you consult a lawyer if you want legal advice.