When I first heard about Dave Ramsey’s baby steps there were a few things that I struggled to grasp like his notion that you want to use any excess cash you have to pay off debt so that all you have in your emergency account is $1,000. The second thing was to hold off on ALL retirement investing until you are debt free. However, if you can’t pay off all your debts in 2 years then you should contribute enough to get at least the company match. I’ve read multiple conflicting views on this where some people say the idea is ludicrous and you should still invest up to the company match while trying to pay off debt because it’s a guaranteed return and free money. It’s a generic answer but I believe it is this: it depends – personal finance is PERSONAL therefore it all depends on your situation and how comfortable you are with your current financial condition.

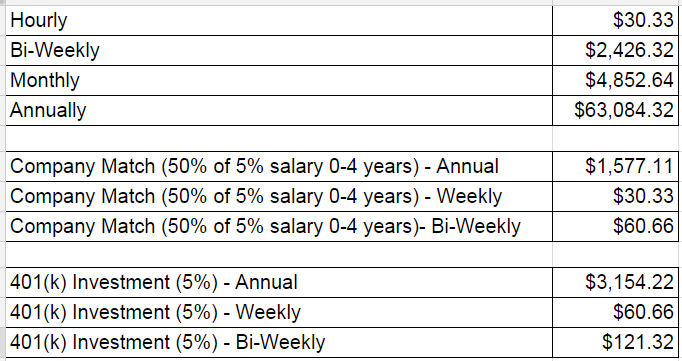

I did a lot of research on Google and there were good arguments from both sides however I decided to run the numbers for my situation and my conclusion also depended on my current financial standing as I mentioned above. Below is a spreadsheet I used to calculate the amount I would be investing in my 401(k), the company match, and how that plays into my goal of getting debt free.

401(k) contributions are pre-tax therefore it makes the calculations for your contribution amount and company match a lot easier. As you can see from above, my annual salary is $63k and if I invested 5% of that (just enough to get the company match) I would be putting $3,154 into my 401(k) while the company would match with $1,577. The company match also varies because some companies might give you the full 5% of salary while others might be less – my company matches 50% of the 5% from years 0-4 and increases as you gain more seniority in the company.

401(k) contributions are pre-tax therefore it makes the calculations for your contribution amount and company match a lot easier. As you can see from above, my annual salary is $63k and if I invested 5% of that (just enough to get the company match) I would be putting $3,154 into my 401(k) while the company would match with $1,577. The company match also varies because some companies might give you the full 5% of salary while others might be less – my company matches 50% of the 5% from years 0-4 and increases as you gain more seniority in the company.

I am losing $1,577 of free money every year by not investing 5% in my 401(k) – I suggest everyone do this calculation so that you have a concrete number that you can visualize. To be honest, I thought it was a lot more than this so I was little shocked when I saw it was only $1,500 bucks. The other big part of this equation is that I’ll also be giving up $3,154 of income (this $$ be lower due to taxes) that I could use to pay off my debt. Ultimately, my decision to stop ALL retirement investing came to 3 factors:

1. The company match was “minimal”

If it was $5,000 then this would be a different story but it was only $1,500! The amount was not substantial enough to dilute my goal of getting debt free!

2. I plan on getting debt-free within 2 years

My goal was to be debt-free by January 2017 and my current schedule shows me being a few months ahead of that. I’m also an avid saver therefore I had no fears of increasing my retirements savings once I’m debt-free.

3. I’m young and already have a decent amount in my retirement accounts.

This is probably the biggest reason because I’m 26 and I have $72k in my IRA and 401k. From my research, I know that amount is years ahead of my peers therefore I was comfortable of where I stood in regards to retirement savings.

I had a lot of trouble deciding on stopping my 401k contribution but at the end of the day I lived by this quote for my debt-free journey:

“If you really want to do something, you’ll find a way. If you don’t, you’ll find an excuse.” – Jim Rohn

I didn’t want to dilute my focus by one atom therefore I stopped my 401k contribution and never looked back. The best way to decide is to do the calculation I did above for your situation and take into the factors that I considered like your age, what’s currently in your retirement savings, and what is the company match policy for your 401k.

Good luck!