When I first heard about Dave Ramsey’s baby steps there were a few things that I struggled to grasp like his notion that you want to use any excess cash you have to pay off debt so that all you have in your emergency account is $1,000. The second thing was to hold off on ALL retirement investing until you are debt free. However, if you can’t pay off all your debts in 2 years then you should contribute enough to get at least the company match. I’ve read multiple conflicting views on this where some people say the idea is ludicrous and you should still invest up to the company match while trying to pay off debt because it’s a guaranteed return and free money. It’s a generic answer but I believe it is this: it depends – personal finance is PERSONAL therefore it all depends on your situation and how comfortable you are with your current financial condition.

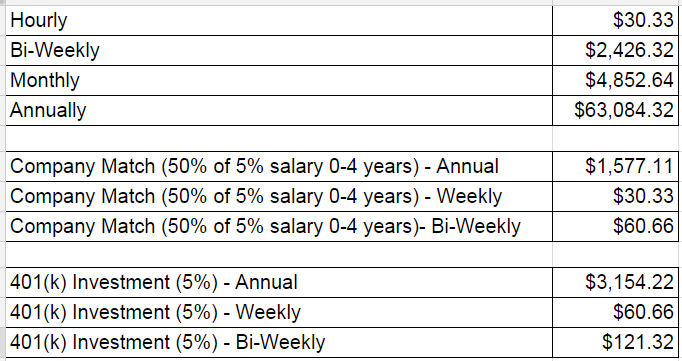

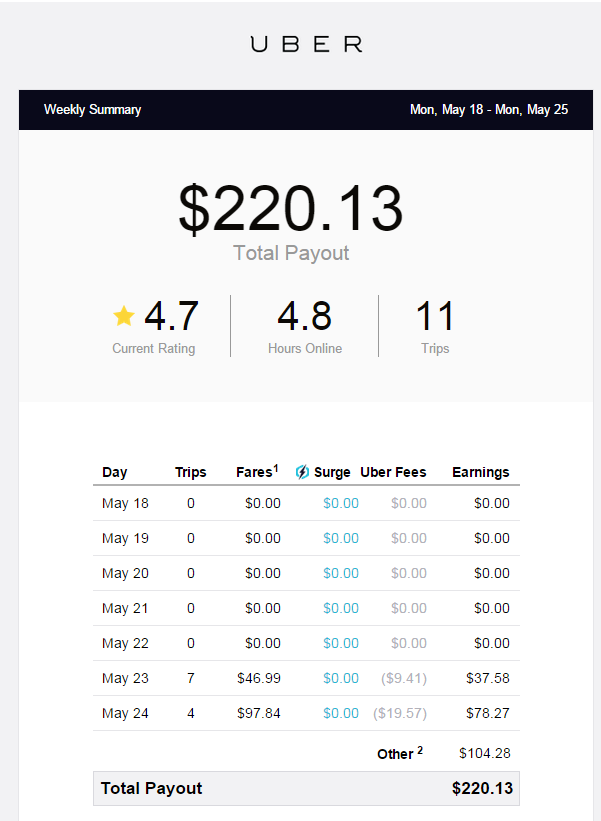

I did a lot of research on Google and there were good arguments from both sides however I decided to run the numbers for my situation and my conclusion also depended on my current financial standing as I mentioned above. Below is a spreadsheet I used to calculate the amount I would be investing in my 401(k), the company match, and how that plays into my goal of getting debt free.

401(k) contributions are pre-tax therefore it makes the calculations for your contribution amount and company match a lot easier. As you can see from above, my annual salary is $63k and if I invested 5% of that (just enough to get the company match) I would be putting $3,154 into my 401(k) while the company would match with $1,577. The company match also varies because some companies might give you the full 5% of salary while others might be less – my company matches 50% of the 5% from years 0-4 and increases as you gain more seniority in the company.

401(k) contributions are pre-tax therefore it makes the calculations for your contribution amount and company match a lot easier. As you can see from above, my annual salary is $63k and if I invested 5% of that (just enough to get the company match) I would be putting $3,154 into my 401(k) while the company would match with $1,577. The company match also varies because some companies might give you the full 5% of salary while others might be less – my company matches 50% of the 5% from years 0-4 and increases as you gain more seniority in the company.

I am losing $1,577 of free money every year by not investing 5% in my 401(k) – I suggest everyone do this calculation so that you have a concrete number that you can visualize. To be honest, I thought it was a lot more than this so I was little shocked when I saw it was only $1,500 bucks. The other big part of this equation is that I’ll also be giving up $3,154 of income (this $$ be lower due to taxes) that I could use to pay off my debt. Ultimately, my decision to stop ALL retirement investing came to 3 factors:

1. The company match was “minimal”

If it was $5,000 then this would be a different story but it was only $1,500! The amount was not substantial enough to dilute my goal of getting debt free!

2. I plan on getting debt-free within 2 years

My goal was to be debt-free by January 2017 and my current schedule shows me being a few months ahead of that. I’m also an avid saver therefore I had no fears of increasing my retirements savings once I’m debt-free.

3. I’m young and already have a decent amount in my retirement accounts.

This is probably the biggest reason because I’m 26 and I have $72k in my IRA and 401k. From my research, I know that amount is years ahead of my peers therefore I was comfortable of where I stood in regards to retirement savings.

I had a lot of trouble deciding on stopping my 401k contribution but at the end of the day I lived by this quote for my debt-free journey:

“If you really want to do something, you’ll find a way. If you don’t, you’ll find an excuse.” – Jim Rohn

I didn’t want to dilute my focus by one atom therefore I stopped my 401k contribution and never looked back. The best way to decide is to do the calculation I did above for your situation and take into the factors that I considered like your age, what’s currently in your retirement savings, and what is the company match policy for your 401k.

Good luck!

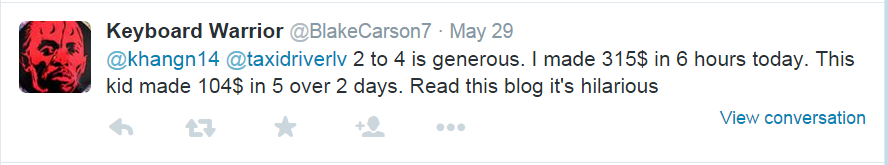

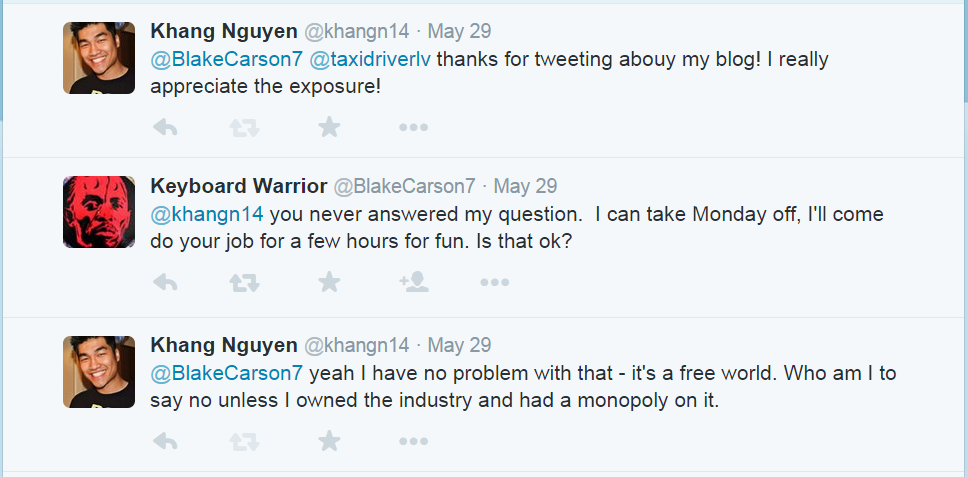

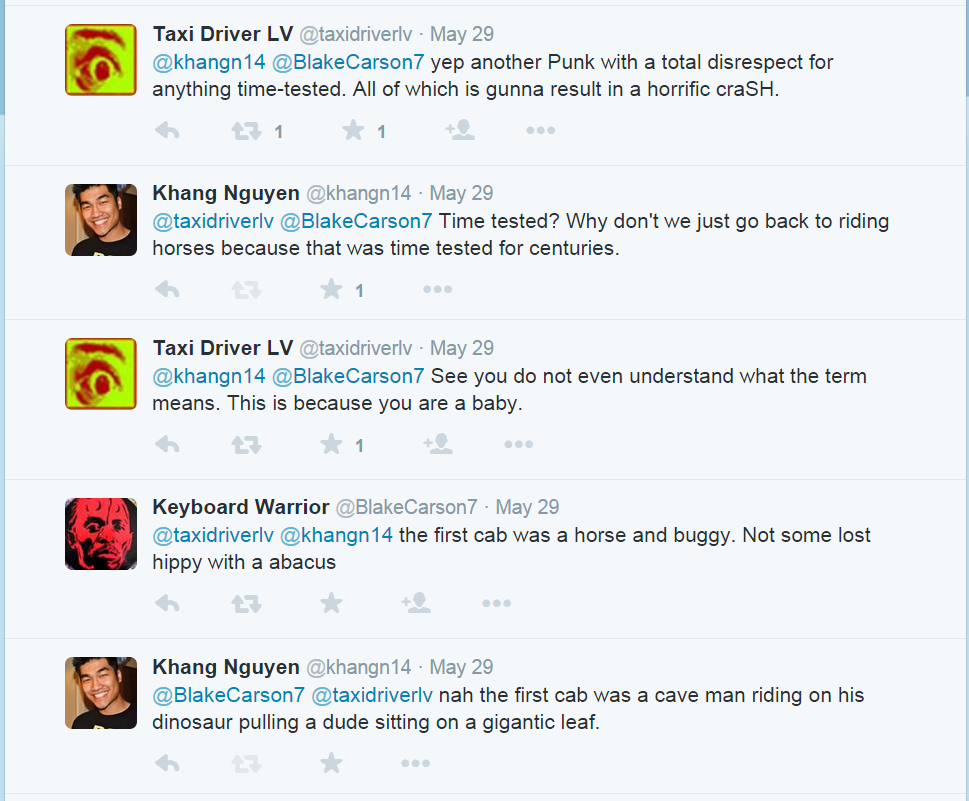

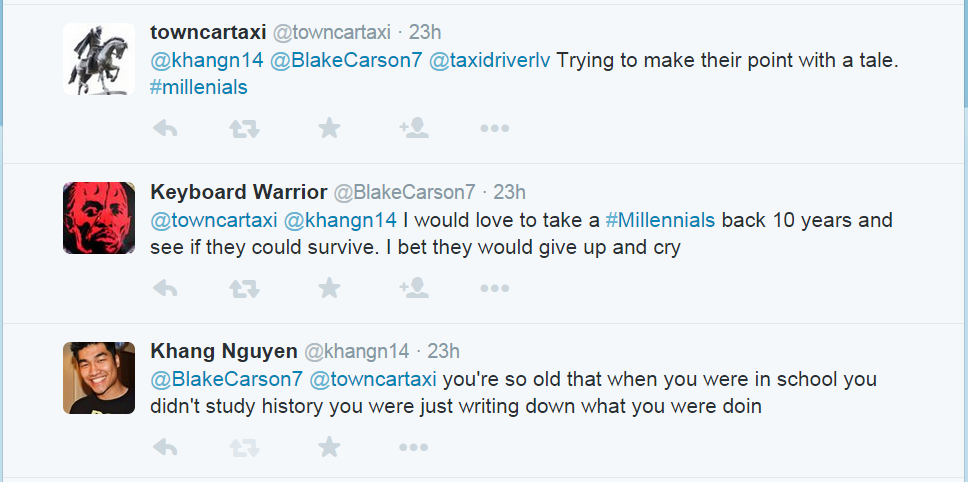

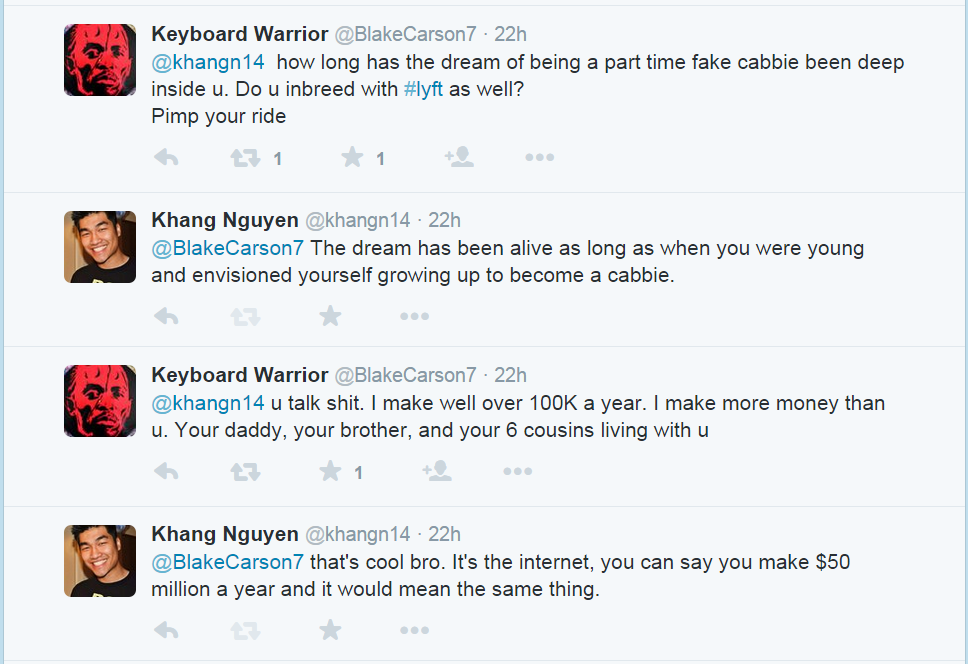

Then the wild troll appeared.

Then the wild troll appeared.

A

A

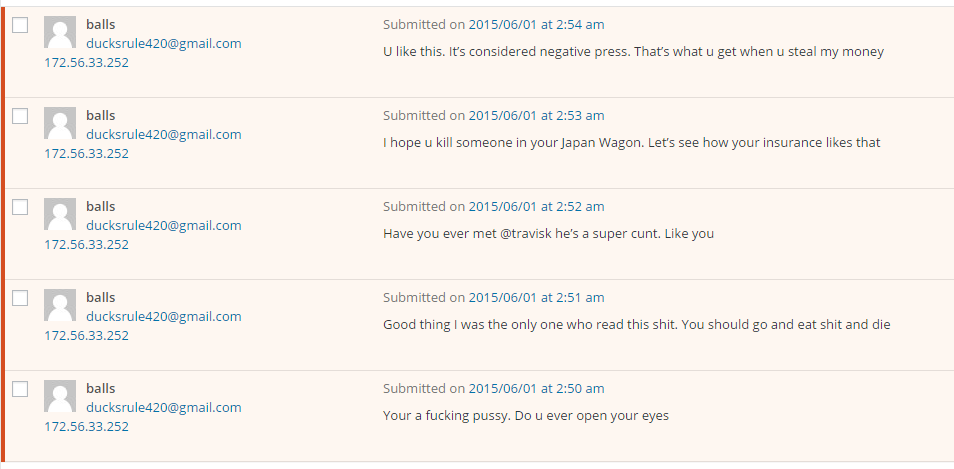

P.S. He then proceeds to post comments on my blog that I chose not to publish. Just goes to show you what people will say when they’re hiding behind their computer screen. FYI, @travisk is the CEO of Uber.

P.S. He then proceeds to post comments on my blog that I chose not to publish. Just goes to show you what people will say when they’re hiding behind their computer screen. FYI, @travisk is the CEO of Uber.

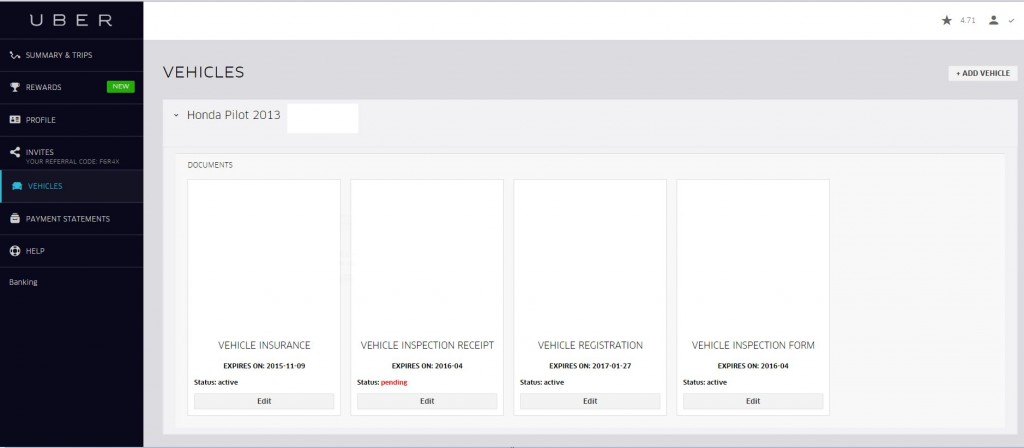

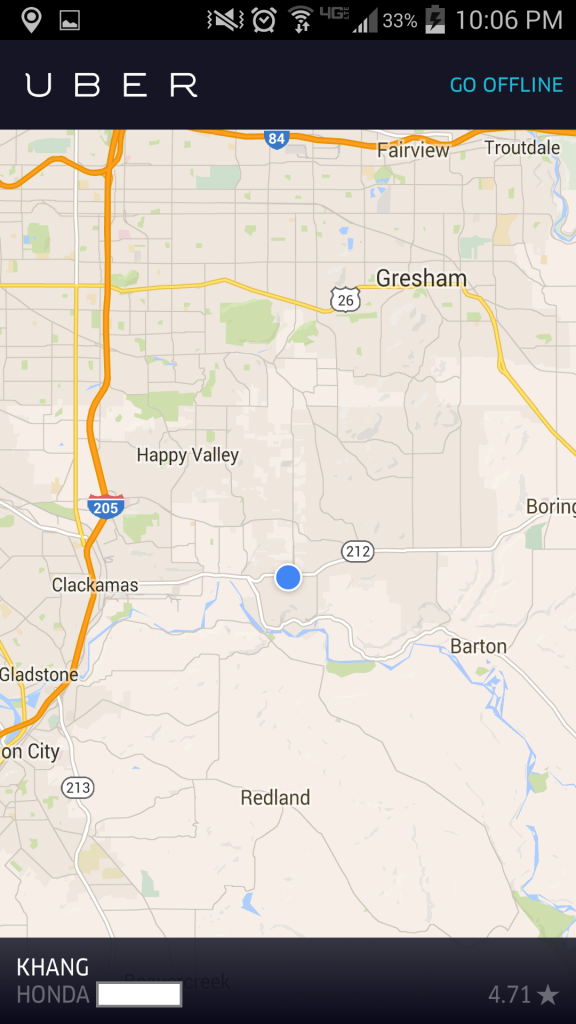

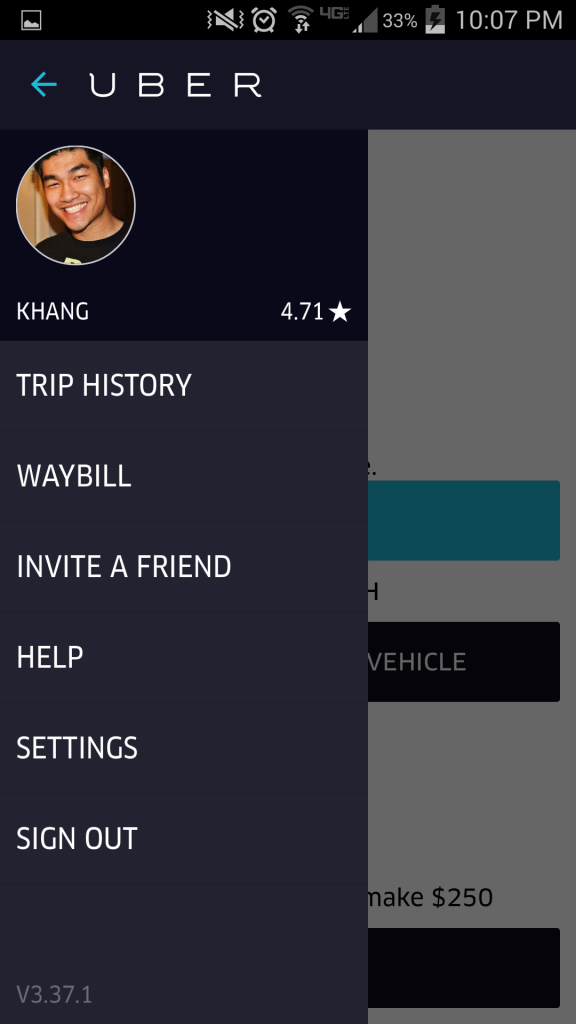

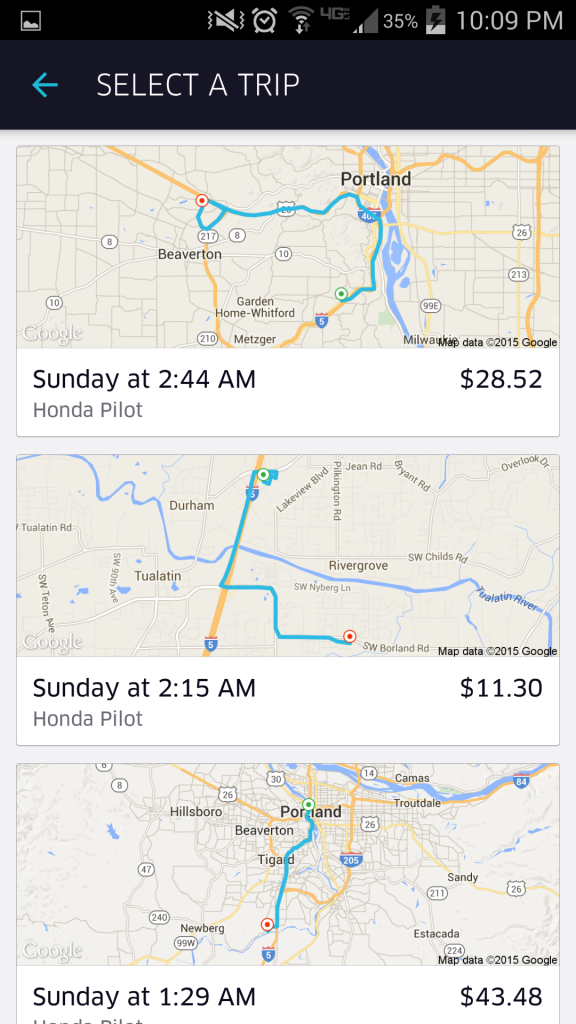

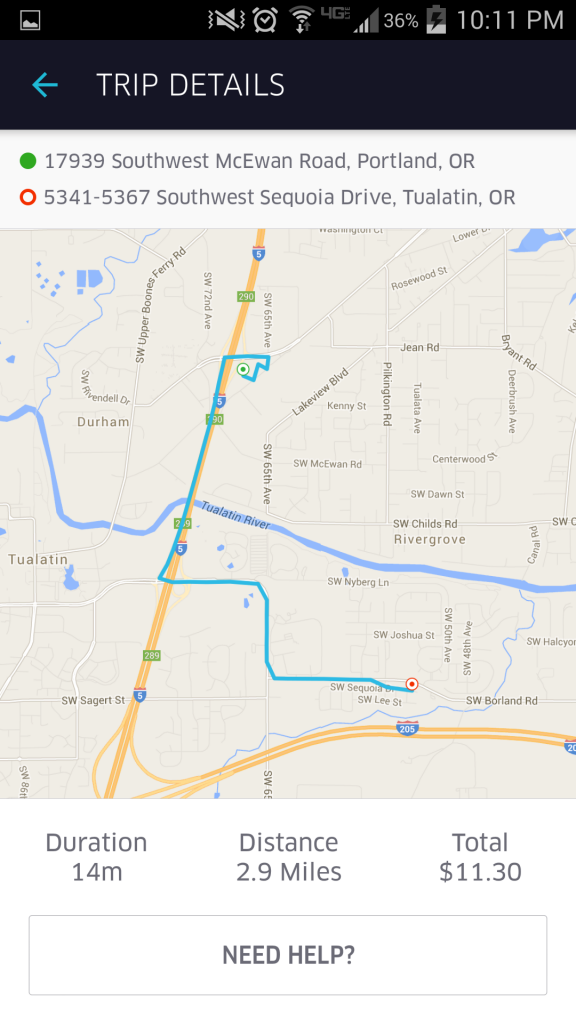

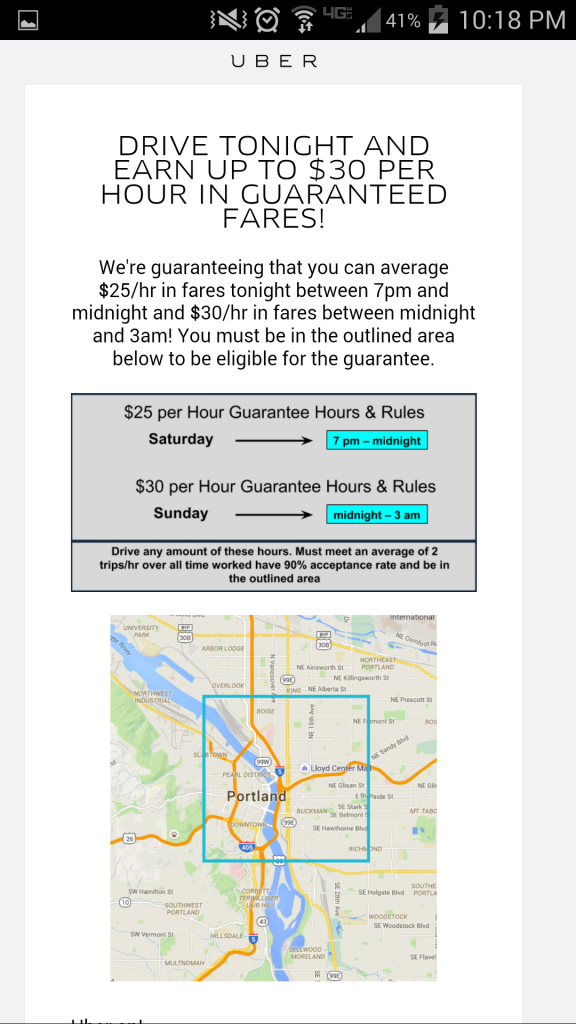

Uber will also run a background check and you can request to be cc’d on the documents (which I did) to see what the cops are saying about you! The check includes driving history along with a criminal scan. They’ll also put a small deposit into your checking account to validate it for direct deposit – mine was a $0.01 deposit. The background check will take 5-7 business days while the document review usually takes 24 hours. The whole process itself took 3 weeks for me with the most difficult part being getting the vehicle inspection completed around my work schedule. Once Uber checks that you’re all good to go they’ll send you a link to download the Uber Partner app and activate your account.

Uber will also run a background check and you can request to be cc’d on the documents (which I did) to see what the cops are saying about you! The check includes driving history along with a criminal scan. They’ll also put a small deposit into your checking account to validate it for direct deposit – mine was a $0.01 deposit. The background check will take 5-7 business days while the document review usually takes 24 hours. The whole process itself took 3 weeks for me with the most difficult part being getting the vehicle inspection completed around my work schedule. Once Uber checks that you’re all good to go they’ll send you a link to download the Uber Partner app and activate your account.

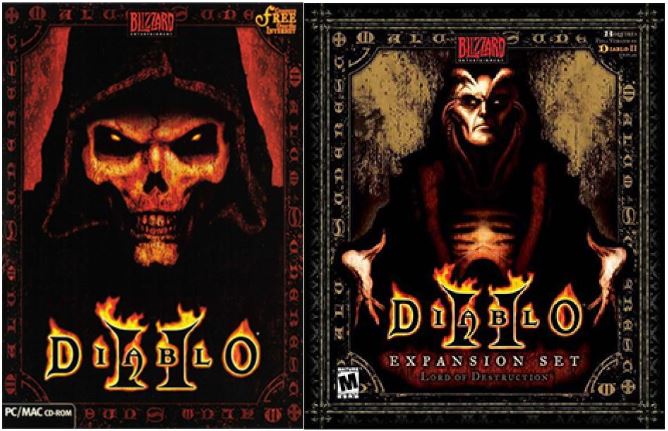

This is a lesson I learned from wanting to play different hero classes and didn’t want to trudge through finding/trading items as I leveled up. I was lucky to be in a position where I could fully furnish any character I wanted with just a few days of trading. For every new character I created, I did extensive research on what the best items, builds, skill sets, and attribute allocations were. I searched forums, talked to players in-game, and ultimately modified the build according to my own knowledge of the game. Therefore, as soon as my character was created and “rushed” I was able to hit the ground running and didn’t waste time learning how the character worked, I already had everything planned and figured out from the start. This lesson has transcended to my everyday life where I do extensive research and calculations before I begin any time consuming task or something that has any risk aspect.

This is a lesson I learned from wanting to play different hero classes and didn’t want to trudge through finding/trading items as I leveled up. I was lucky to be in a position where I could fully furnish any character I wanted with just a few days of trading. For every new character I created, I did extensive research on what the best items, builds, skill sets, and attribute allocations were. I searched forums, talked to players in-game, and ultimately modified the build according to my own knowledge of the game. Therefore, as soon as my character was created and “rushed” I was able to hit the ground running and didn’t waste time learning how the character worked, I already had everything planned and figured out from the start. This lesson has transcended to my everyday life where I do extensive research and calculations before I begin any time consuming task or something that has any risk aspect. Photo sources:

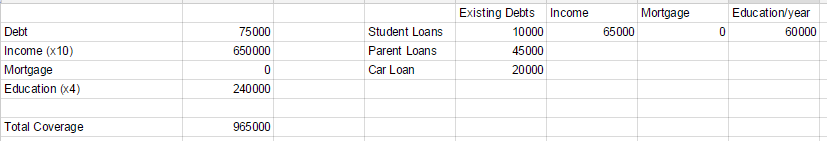

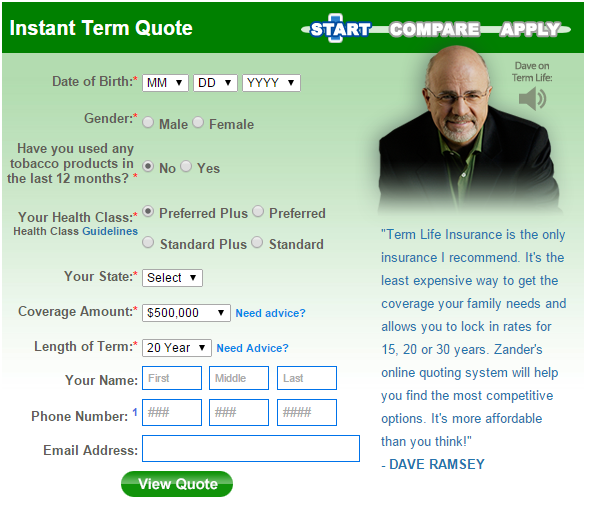

Photo sources: The second question is, “what type of insurance should I get?”. The two most widely used out there is Whole Life and Term Life insurance. Whole Life provides you with a coverage amount you set and a higher premium where the additional dollars above your premium goes into an account that builds your “equity”. Dave Ramsey does not approve this method as you can make more money by taking those additional dollars and invest it yourself. Also, life insurance is not needed for your “Whole” life because as soon as you become fairly wealthy then your family should be financially stable enough to handle any money issues. Term life insurance is similar to car insurance where you pick an amount of coverage and a “term” of how long you want the insurance for. This is the one that I went with because, as I mentioned before, you shouldn’t need life insurance for the rest of your life and it provides the best option with the lowest premium.

The second question is, “what type of insurance should I get?”. The two most widely used out there is Whole Life and Term Life insurance. Whole Life provides you with a coverage amount you set and a higher premium where the additional dollars above your premium goes into an account that builds your “equity”. Dave Ramsey does not approve this method as you can make more money by taking those additional dollars and invest it yourself. Also, life insurance is not needed for your “Whole” life because as soon as you become fairly wealthy then your family should be financially stable enough to handle any money issues. Term life insurance is similar to car insurance where you pick an amount of coverage and a “term” of how long you want the insurance for. This is the one that I went with because, as I mentioned before, you shouldn’t need life insurance for the rest of your life and it provides the best option with the lowest premium.

Driver’s License

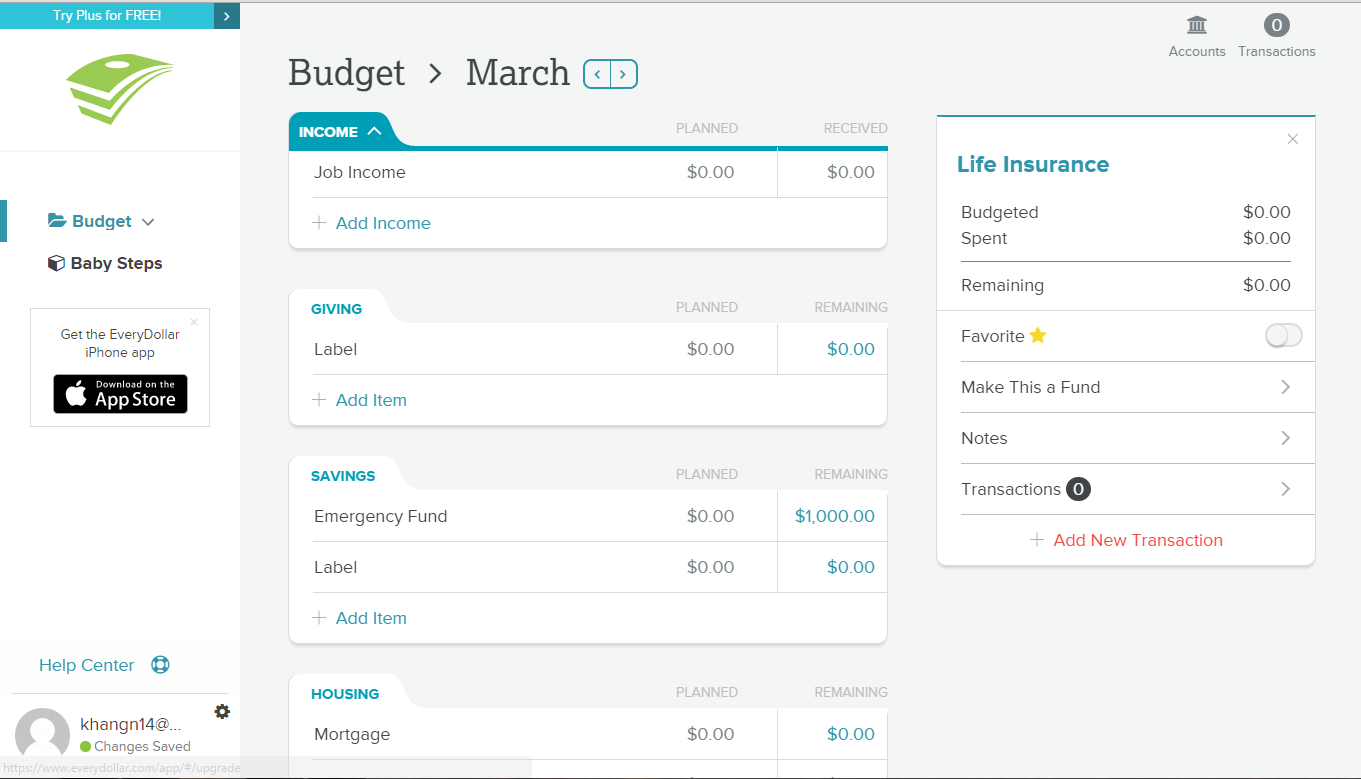

Driver’s License The website itself is very beautiful and easy to navigate as you can see below. Categories are very cleanly separated with a distinguished tab to help you differentiate between your budget items; the initial category is your income where your budget should start and the default categories are giving, savings, housing, transportation, food, lifestyle, insurance & tax, and lastly your debt. These categories then have smaller sub-categories where you can add your own custom budget line item. An extra item they have on the side is the “Baby Steps” which is Dave Ramsey’s steps to becoming financially wealthy and I think it’s a nice touch but seems a little weird to me that it’s included in the tool – but it’s his budgeting tool so how could he not sneak it in there??

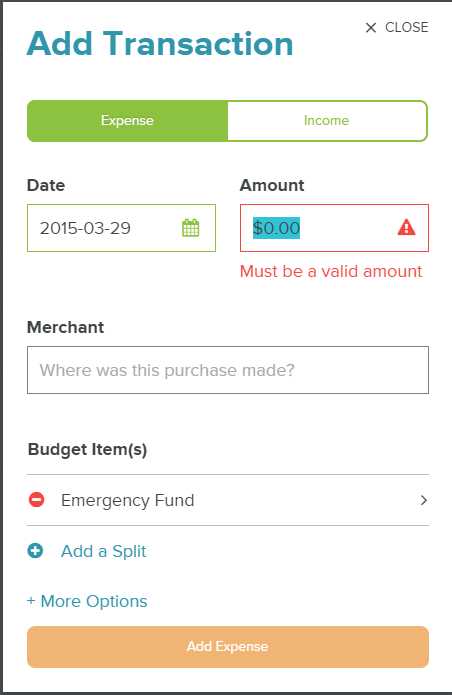

The website itself is very beautiful and easy to navigate as you can see below. Categories are very cleanly separated with a distinguished tab to help you differentiate between your budget items; the initial category is your income where your budget should start and the default categories are giving, savings, housing, transportation, food, lifestyle, insurance & tax, and lastly your debt. These categories then have smaller sub-categories where you can add your own custom budget line item. An extra item they have on the side is the “Baby Steps” which is Dave Ramsey’s steps to becoming financially wealthy and I think it’s a nice touch but seems a little weird to me that it’s included in the tool – but it’s his budgeting tool so how could he not sneak it in there?? The initial step is to put in your monthly income and then move down the line to fill out all you budget items. A nice feature is that as you scroll down the screen, the amount that you have left to budget is locked at the top for you to see. You can also click on the remaining amount and that will toggle the website to switch to how much you’ve spent in your budget. This gets a little annoying because I thought I could change the spent amount by clicking it but I can only do that through the added transactions. Speaking of the transactions, this is where the budget tool fails miserably and makes it no better than a mediocre tool.

The initial step is to put in your monthly income and then move down the line to fill out all you budget items. A nice feature is that as you scroll down the screen, the amount that you have left to budget is locked at the top for you to see. You can also click on the remaining amount and that will toggle the website to switch to how much you’ve spent in your budget. This gets a little annoying because I thought I could change the spent amount by clicking it but I can only do that through the added transactions. Speaking of the transactions, this is where the budget tool fails miserably and makes it no better than a mediocre tool.

After you complete your questionnaire at the kiosk you will sit down in a lobby or wait in line until you’re called by a technician to complete your shortened health screening. Below is a picture of the lobby of the place I used to donate at in Portland. I’ve covered the face of the individuals to protect their privacy.

After you complete your questionnaire at the kiosk you will sit down in a lobby or wait in line until you’re called by a technician to complete your shortened health screening. Below is a picture of the lobby of the place I used to donate at in Portland. I’ve covered the face of the individuals to protect their privacy.

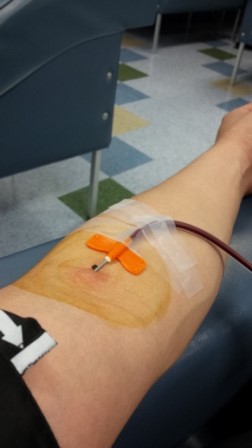

You’ll quickly find out that they ask for your full name and last 4 digits of your social security very often. Not sure if this is to verify if you’re the same person (I know, I know…) or to make sure you’re still thinking properly and not high off your ass. You can’t see in the photo above but there is a scale just behind the chair and that is what they’ll have you do first. This is important because there are 3 ranges for the amount of plasma you have to donate correlating to your weight – I weighed around 160 and was in the middle band which required me to donate 880 ML. At some centers you get more/less money (+/-

You’ll quickly find out that they ask for your full name and last 4 digits of your social security very often. Not sure if this is to verify if you’re the same person (I know, I know…) or to make sure you’re still thinking properly and not high off your ass. You can’t see in the photo above but there is a scale just behind the chair and that is what they’ll have you do first. This is important because there are 3 ranges for the amount of plasma you have to donate correlating to your weight – I weighed around 160 and was in the middle band which required me to donate 880 ML. At some centers you get more/less money (+/-

After you near the end of your donation, they’ll either give you a saline pack through the IV or make you drink a bottle of electrolytes (Powerade or Gatorade) to help you replenish the fluids you’ve just lost. After that you’re all done and you get paid!

After you near the end of your donation, they’ll either give you a saline pack through the IV or make you drink a bottle of electrolytes (Powerade or Gatorade) to help you replenish the fluids you’ve just lost. After that you’re all done and you get paid!